Crypto and financial markets are experiencing a sense of déjà vu as analysts compare the current macroeconomic outlook to past cycles, particularly the previous Trump-era trade wars.

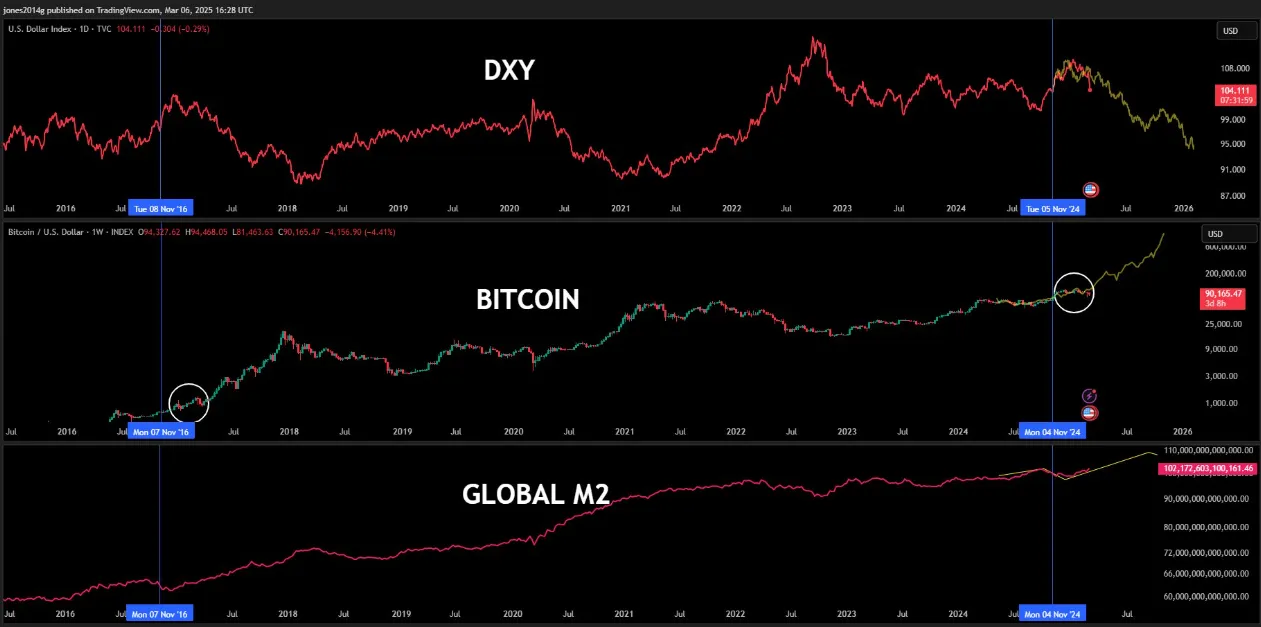

As traders and investors wait with bated breath for a crypto market recovery, all eyes remain pegged to the US dollar index (DXY) and the M2 Money Supply for possible hints.

Bitcoin, Altcoins & Tariffs: Is a 2017-Style Rally Ahead?

A recent chart from ZeroHedge highlights how the US Dollar Index (DXY) in 2025 closely mirrors its 2016 movements. This adds credence to the idea that market trends echo past patterns.

This parallel has drawn significant attention from investors, particularly in the crypto sector. Analysts assess whether Bitcoin (BTC) and altcoins will follow a similar trajectory to their 2017 bull cycle.

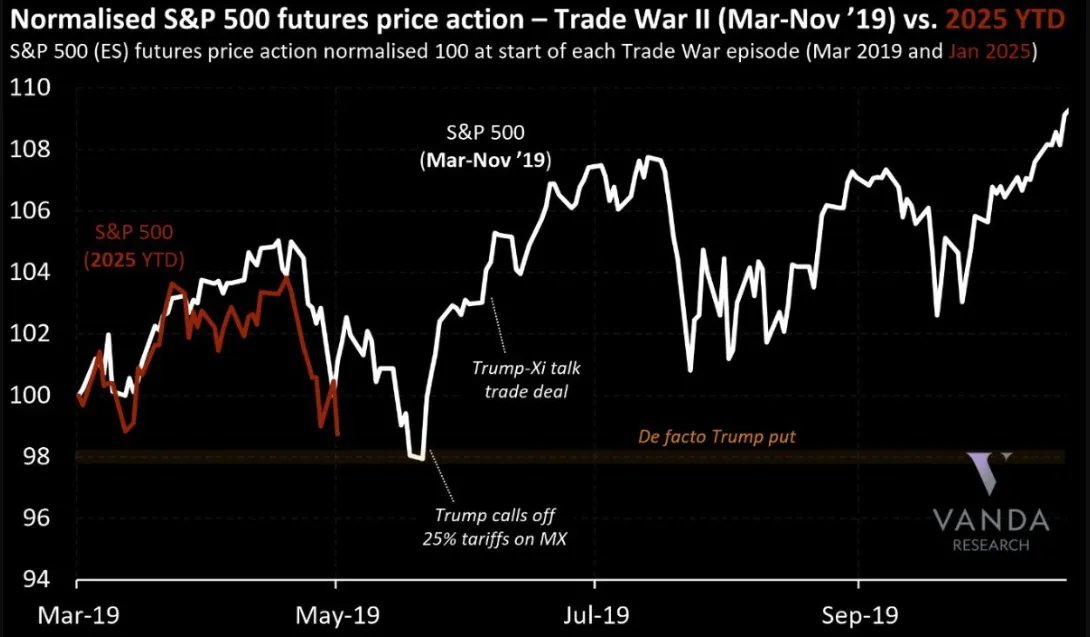

Financial market commentary, The Kobeissi Letter, weighed in on this discussion, emphasizing the similarities between Trump Tariff War 1.0 and 2.0.

The commentary acknowledges that today’s macroeconomic conditions differ from those of the previous Trump administration. However, it also notes that several technical movements across asset classes, including stocks, gold, oil, and Bitcoin, have been strikingly similar.

So far this year, gold prices have surged over 10%, reflecting a shift toward safer assets. Meanwhile, Bitcoin has declined nearly 10%. This divergence highlights the importance of risk appetite in shaping market sentiment.

Bitcoin’s recent price action further validates these observations. On March 4, Bitcoin experienced an abrupt $2,000 drop in just 25 minutes, approaching the resistance level at $90,000. Market participants have noted that cryptocurrency valuations frequently shift by over $100 billion, even without material news.

This suggests that liquidity-driven movements and technical resistance levels play a dominant role in price fluctuations. In this regard, The Kobeissi Letter noted that long-term investors who took advantage of volatility during Trump Trade War 1.0 found excellent bargain opportunities. This suggests that similar conditions could arise again.

Altcoin Season To Align with Trump Season

Meanwhile, a growing narrative within the crypto space is that “Altcoin Season” could align with “Trump Season.” Crypto investor and analyst bitcoindata21 highlighted how Bitcoin’s price action in 2025 resembles the 2017 cycle. This observation reinforces the belief that a major altcoin rally could be on the horizon.

Historical trends suggest that a strengthening Bitcoin market often precedes explosive growth in altcoins as capital rotates. This raises the possibility that an upcoming bullish cycle could mirror the altcoin boom seen during Trump’s first term.

Elsewhere, broader economic trends also point to potential upside for Bitcoin. As BeInCrypto reported, the DXY recently fell below a key support level, which has historically been a bullish signal for Bitcoin. A weakening dollar tends to push investors toward alternative assets such as cryptocurrencies and gold.

Additionally, analysts have highlighted the expanding M2 money supply as another factor that could fuel a Bitcoin rally. Historically, expansions in M2 have coincided with major Bitcoin bull runs, with experts predicting a surge in late March as liquidity conditions improve.

For now, uncertainty remains high due to macroeconomic factors and policy shifts. However, history suggests that investors strategically position themselves during volatile periods and often reap significant rewards.

If the pattern from 2017-2020 repeats, Bitcoin and altcoins could enter a renewed bull cycle in the coming months. Nevertheless, traders should remain vigilant, as short-term volatility remains a key characteristic of the current market environment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen