After consistent bearish signals, President Trump’s surprise announcement of EU tariffs has devastated Bitcoin and the broader crypto market. Crypto-related traditional stocks are feeling the heat as the contagion spreads.

Bitcoin ETF outflows are at a record high, the price of BTC is below $85,000, and liquidations are nearly at $745 million. We may be on the precipice of a bear market or genuine crypto crash, but the community must stay strong.

Did Tariffs Trigger a Bitcoin Crash?

Donald Trump’s proposed tariffs are looming over the markets today, and crypto is acting like the sky is falling. Although Bitcoin and other assets recovered after tariffs against Canada and Mexico were postponed, Trump recently confirmed that he plans to enact them, spiking the crypto market.

Today, he followed this by hinting at a new 25% tariff against the European Union.

“We have made a decision and we’ll be announcing it very soon. It’ll be 25 per cent generally speaking, and that will be on cars and all other things,” Trump said in his first Cabinet meeting.

With the price of Bitcoin already wobbling, new US tariffs are pushing the token towards the abyss. The asset began the week with losses, and $500 million in ETF outflows helped spur fears of an impending bear market.

Today, weekly BTC ETF outflows hit their all-time high, and Bitcoin’s price dipped below $85,000 for the first time since early November.

The Contagion Spread Across Crypto Stocks

So far, CoinGlass data shows total liquidations of just under $745 million. This is on top of the $1.5 billion liquidation seen yesterday. Crypto-related stocks are also taking a hard hit.

Strategy (formerly MicroStrategy) is closely entangled with the price of Bitcoin, thanks to its massive stockpiles. Recently, it bought nearly $2 billion in BTC, but its stock price lagged.

Today, its stock also plunged, fueling speculation it might have to liquidate its stockpile. The stock’s price has since recovered somewhat, but it looks very shaky.

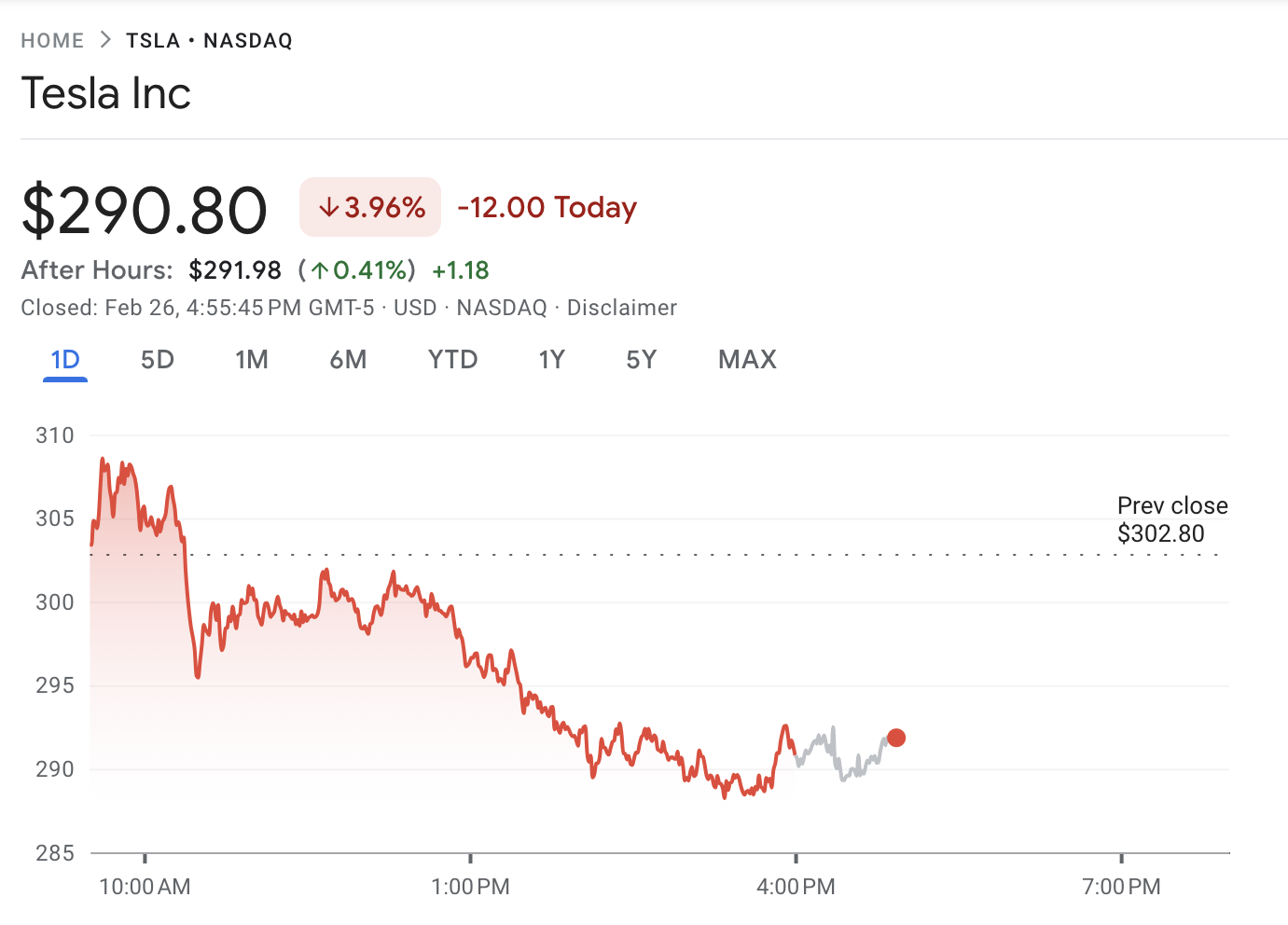

Coinbase, too, saw temporary drops due to the tariffs’ impact on Bitcoin, but its revenue streams are quite diversified. Tesla, on the other hand, counts Bitcoin returns as a substantial portion of its revenue.

Between the steep drop in the crypto market and growing dissatisfaction from its traditional product buyers, the firm’s price is in trouble.

In short, Bitcoin and the rest of the crypto market fell hard, and Trump’s tariffs may or may not be the most direct trigger. Bearish indicators have been popping up for days, whereas Trump announced these EU tariffs with little fanfare.

After all, record-breaking hacks and shameless social media scams are only growing. Maybe it’s time for a correction.

Nonetheless, even if the crypto community’s worst fears do come true in the short term, that is no cause for despair. This industry is historically volatile, and it has always recovered from the largest crashes.

Whether these tariffs reduce Bitcoin to a fraction of its recent value or not, the community will remain resilient and innovative.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen