Berachain (BERA) price has struggled to maintain its initial valuation, quickly dropping from $15 just hours after launch. Like many new L1 and L2 chains, it now faces the challenge of proving its long-term value beyond the early hype.

While its indicators currently suggest weak market momentum, some analysts remain optimistic about its strong community and developer activity. With key resistance and support levels in play, the next moves for BERA will be crucial in determining whether it can recover lost ground or face continued downward pressure.

Can BERA Avoid the Fate of Other Struggling Chains?

Berachain price quickly dropped from $15 just hours after launch, raising concerns about its ability to maintain momentum. Like many new chains, it now needs to prove its value after its airdrop.

Many recent L1 and L2 launches, including Starknet, Mode, Blast, zkSync, Scroll, and Dymension, have struggled to hold their prices. Hyperliquid is a rare exception, with strong revenue and a 19% price increase in the last 30 days.

Users have been pointing out some concerns about the project, with X user Ericonomic saying one of its biggest concerns is related to BERA private investors:

“Berachain sold more than 35% of its token supply to private investors (I thought it was just 20%), with the seed round sold at $50M FDV, the second round at $420M FDV, and the last one at $1.5B FDV. These are a lot of tokens. Most projects sell 20% of their supply privately and I already think that’s too much and causes a lot of harm to the project. This number of tokens sold, plus its long vesting, creates permanent sell pressure until all of them are vested, which usually leads to down-only charts in projects that launch at multiples FDV (aka high FDV, low float),” Ericonomic wrote on X (formerly Twitter).

He also points out that one of the Berachain founders is selling its tokens.

“The cofounder is selling tokens from one of his doxxed addresses. He got around 200k BERA from the airdrop (this is a really bad thing since he—or the core—designed the airdrop) and then he swapped some of those tokens for WBTC, ETH, BYUSD, etc,” Ericonomic wrote.

BERA Indicators Suggest a Weak Market Momentum

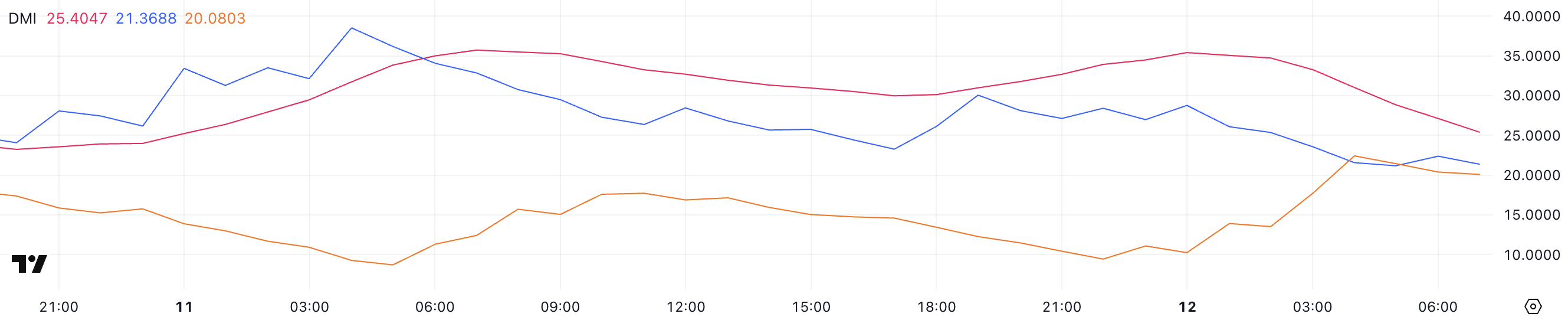

BERA DMI chart shows a weakening trend, with the ADX dropping from 35 to 25.4, indicating that trend strength is fading. The +DI at 21.3 and -DI at 20 suggests a near-balance between buyers and sellers, meaning no clear directional momentum.

If the ADX continues to decline, it could signal choppy price action rather than a strong move in either direction. A resurgence in either +DI or -DI could clarify the next trend.

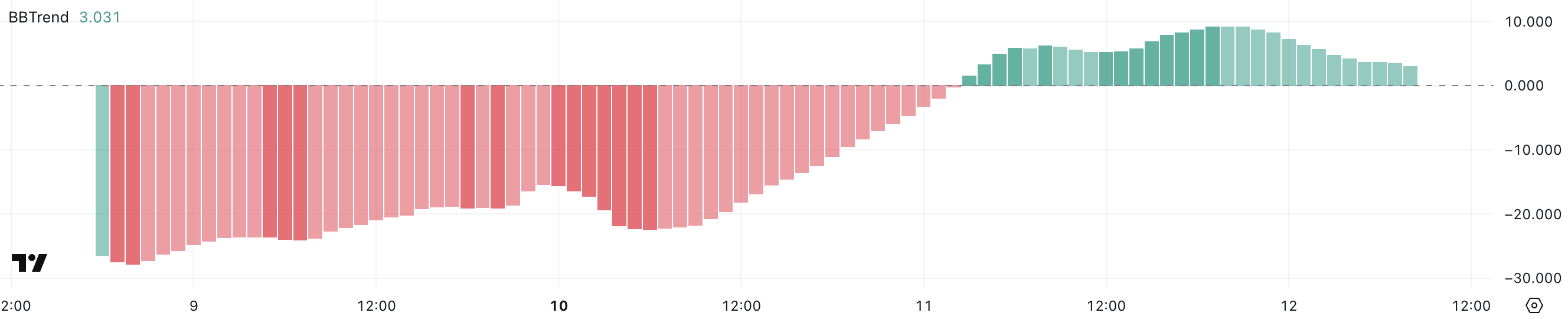

BERA’s BBTrend turning positive after a prolonged negative period suggests a shift in market sentiment, but the recent decline hints at potential exhaustion.

After hitting a high of 9.1 yesterday, the indicator’s downturn could mean bullish momentum is slowing. If it continues falling, BERA might struggle to sustain its recovery and could enter a consolidation or retracement phase.

Both indicators suggest BERA is at a critical point, with fading momentum and uncertainty about its next move. If buying pressure strengthens, it could push higher, but if weakness persists, a reversal or sideways action becomes more likely.

The coming sessions will be key in determining whether the recent positive shift can hold.

BERA Price Prediction: Can BERA Recover $7 Levels?

BERA’s EMA lines indicate a lack of clear direction, with price movement depending on whether momentum builds. A push upward could lead to a test of the $6.3 resistance, with potential for a further rise to $7.2 if broken.

However, if selling pressure increases, BERA could drop toward $4.7. So far, early price action has been weak, and indicators don’t yet show strong bullish signals.

Despite this, Berachain has strong community support. If its Proof-of-Liquidity (PoL) is implemented, which has almost been the project’s biggest selling point, it could bring fresh buyers into the market.

As of now, BERA is looking quite bearish.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen