VIRTUAL, the token behind Virtuals Protocol, a platform for creating and monetizing AI agents, has jumped 29% in the past 24 hours, emerging as the market’s top gainer.

Despite the spike, large outflows from the VIRTUAL spot market hint that speculative trading, rather than real demand, may be driving the rally, raising doubts about its sustainability.

VIRTUAL Spot Outflows Signal Low Buying Activity

VIRTUAL currently trades at $3.82. Its price has risen 29% over the past 24 hours, putting it ahead of the top 100 cryptos by market capitalization.

However, persistent outflows from its spot market over the past two days raise concerns. According to Coinglass, VIRTUAL’s spot market has seen $4 million in outflows during this period, indicating selloffs.

When an asset’s price climbs, but experiences spot outflows, it suggests that while its market value is increasing, investors may be selling or withdrawing the asset. This indicates caution or a lack of confidence, as some participants might be taking profits.

The lack of broader market participation suggests that VIRTUAL’s price surge is primarily fueled by speculative trading activity from a limited number of investors.

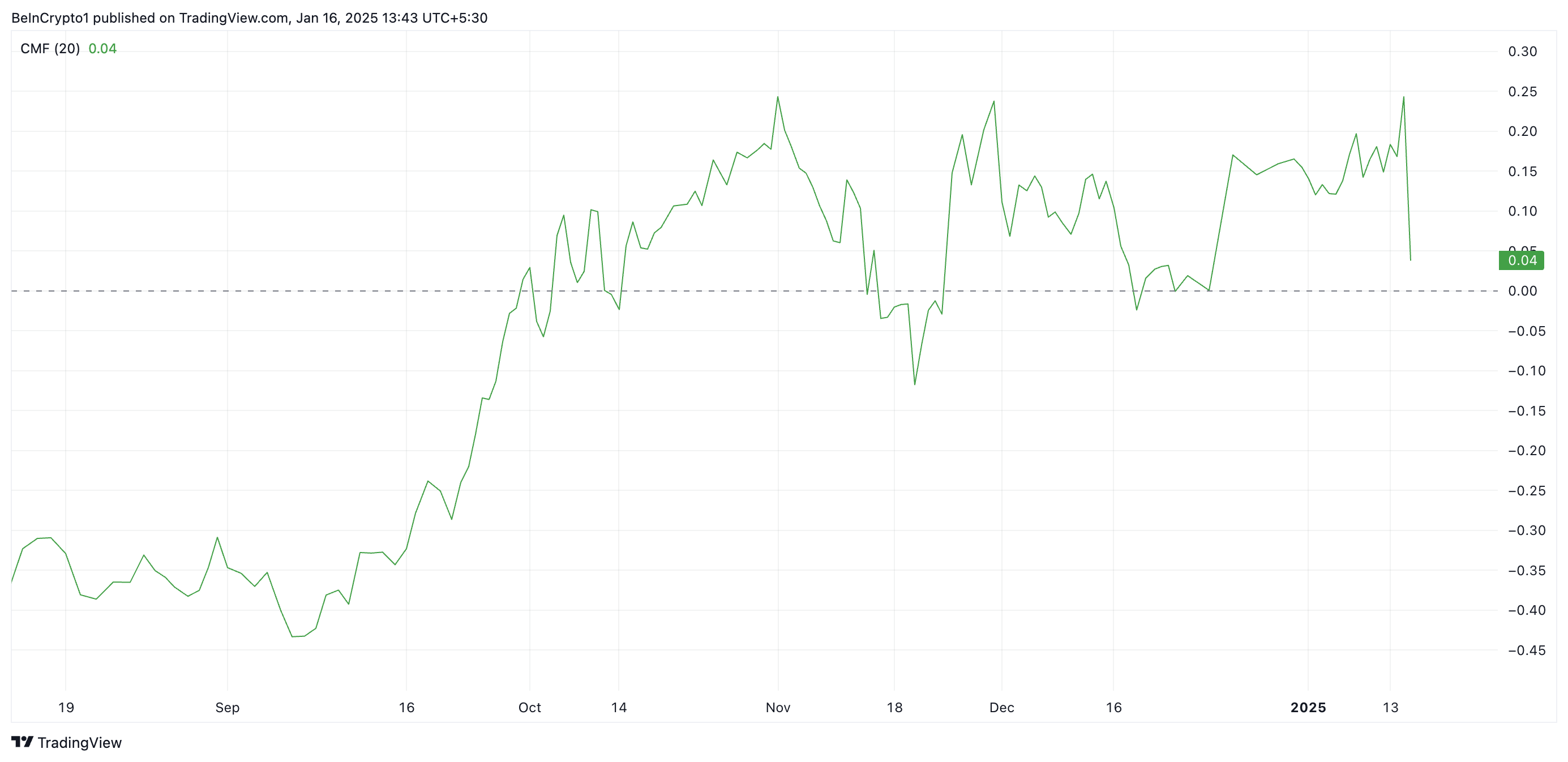

The token’s plummeting Chaikin Money Flow (CMF) confirms this bearish outlook. As of this writing, VIRTUAL’s CMF is in a downward trend and appears poised to fall below the zero line.

When an asset’s price climbs while its CMF drops, strong buying pressure does not support the upward price movement. This indicates that the rally is driven more by short-term factors rather than sustained demand, and there may be a potential for a reversal or weakening in the price trend.

VIRTUAL Price Prediction: Falling Demand Challenges Price Recovery

Readings from VIRTUAL’s Fibonacci Retracement tool show that it currently trades below its all-time high of $5.25, which represents a major resistance level.

However, the token’s waning demand may make revisiting this price peak difficult. Once VIRTUAL selloffs gain pressure, its price will drop to $2.25, where support lies.

On the flip side, if demand for the VIRTUAL token resurges, its price could revisit its all-time high and attempt to rally past it.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen