Movement (MOVE) has gained 10% in the past 24 hours, pushing its market cap to $1.6 billion. Indicators like RSI and ADX confirm the strength of the uptrend, with an RSI of 62 suggesting potential for further gains before hitting overbought territory.

MOVE is positioned to test key resistance levels, including $0.86 and potentially $1.10, marking new highs if the trend continues. However, a failure to sustain the uptrend could lead to a retest of $0.59, a critical support level that, if broken, could result in new lows.

Movement RSI Is Still Below the Overbought Zone

MOVE’s RSI is currently at 62, a significant increase from 46.6 just one day ago, indicating growing bullish momentum. This rise suggests that buying pressure has intensified, supporting the recent surges in MOVE’s price, making it one of today’s top performers among the top 100 altcoins.

However, despite the price gains, MOVE RSI has yet to cross above 70, which means it has not entered overbought territory. This could imply that there is still room for further upward movement before the market becomes overheated.

The RSI (Relative Strength Index) measures the speed and magnitude of price changes to evaluate whether an asset is overbought or oversold. Readings above 70 typically indicate overbought conditions, signaling a potential pullback, while readings below 30 suggest oversold conditions, often preceding a rebound.

With MOVE’s RSI at 62, the market remains in a neutral-to-bullish zone, suggesting a continuation of the uptrend in the short term. However, if the RSI approaches 70, it may indicate a slowing of momentum, potentially leading to a period of consolidation or minor correction.

MOVE Uptrend Is Getting Stronger

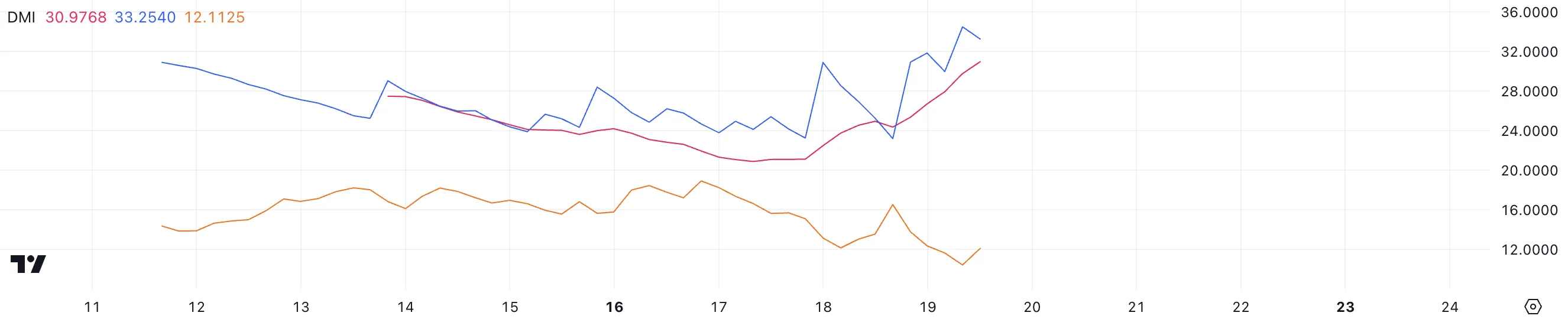

MOVE’s DMI chart shows its ADX at 30.9, up from 21 two days ago, indicating a strengthening trend. The increase in ADX suggests that the current uptrend is gaining momentum, with buyers firmly in control.

With the D+ at 33.2 significantly outpacing the D- at 12.11, the market is clearly dominated by bullish forces, signaling strong upward pressure on MOVE price.

The ADX (Average Directional Index) measures the strength of a trend without indicating its direction. Values above 25 signify a strong trend, while values below 20 indicate a weak or non-trending market.

MOVE’s ADX at 30.9 confirms a strong uptrend, with the D+ showing active buying strength and the D- reflecting minimal selling pressure.

MOVE Price Prediction: Can It Reach Levels Around $1 Again?

Movement has been on the news since its listing on Binance roughly one week ago. If the current uptrend continues, MOVE is likely to test the resistance at $0.86 in the near term.

A successful breakout above this level could pave the way for further gains, with targets at $1.03 and potentially $1.10, making it one of the most interesting altcoins for December.

However, if the uptrend weakens and a downtrend forms, MOVE price could face significant downside risks. The closest strong support lies at $0.59, and a break below this level would lead to new lows for the coin. The coming days will determine whether MOVE sustains its upward trajectory or enters a corrective phase.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen