Onyxcoin price action has entered a tense standoff between bulls and bears. After rallying more than 70% over the past month, XCN corrected nearly 40% from its January highs, erasing most weekly gains and sliding about 7% in the past 24 hours. Yet despite the pullback, the broader structure has not broken.

What makes this moment interesting is what is happening beneath the surface. Selling pressure has collapsed, whales are re-accumulating, and price is still holding key trend levels. The question now is simple: does this setup lead to another breakout, or does hesitation turn into a deeper reset?

Sponsored

Falling Wedge Holds, but Bullish Momentum Is Being Tested

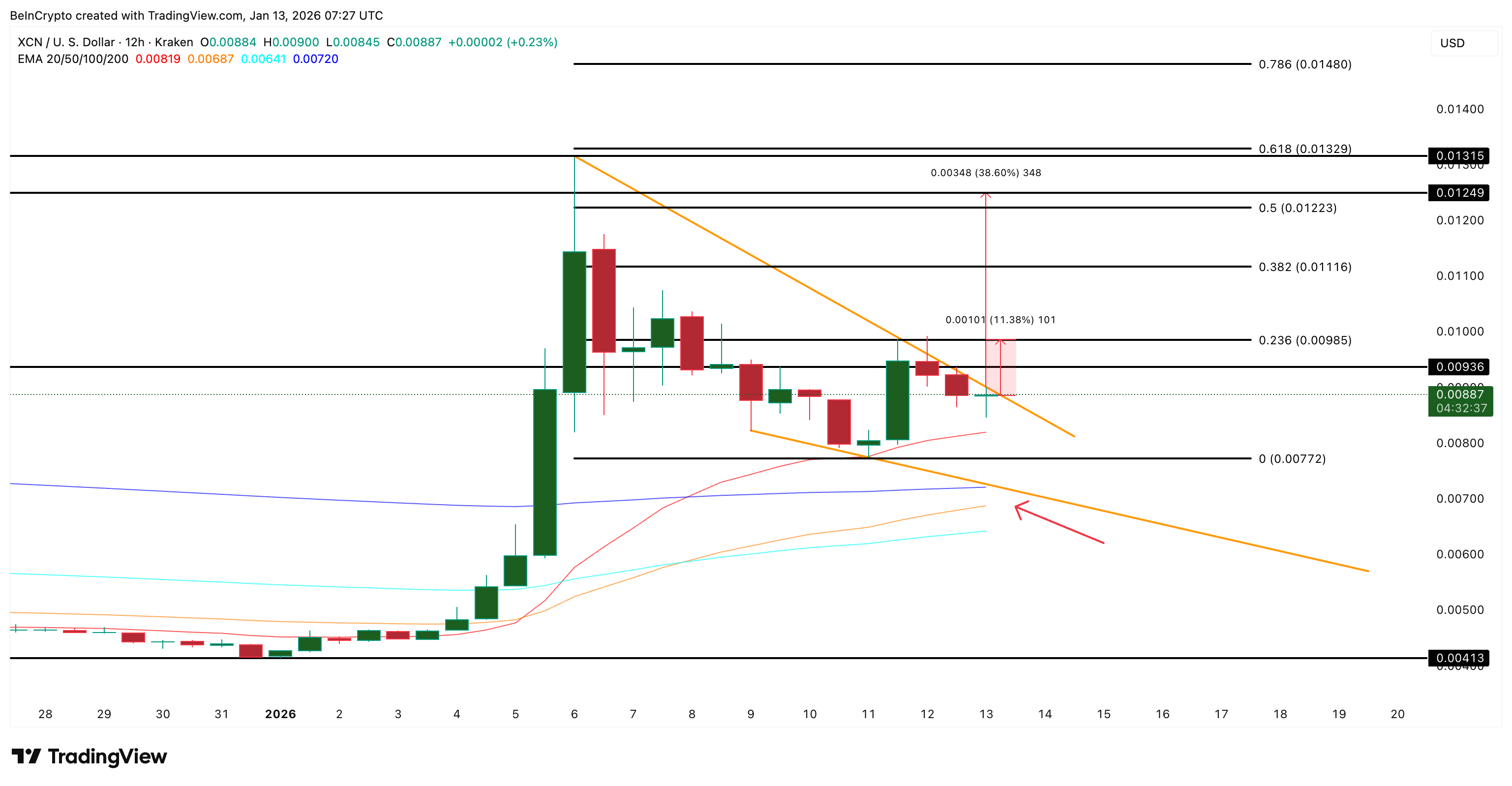

On the 12-hour chart, Onyxcoin continues to trade inside a falling wedge pattern. A falling wedge forms when the price makes lower highs and lower lows within converging trend lines and is typically a bullish continuation structure. When confirmed, it often resolves with a sharp upside move, in this case pointing to a potential 38% breakout.

However, momentum has weakened near the upper boundary of the wedge. Bull–bear power, which measures whether buyers or sellers control short-term price swings, remains positive but has started to fade as the price repeatedly tests resistance. Since January 11, XCN has been rejected multiple times near the upper trend line, explaining why the rally stalled and weekly gains were erased.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This keeps the pattern valid but slightly weak. Bulls still control the structure, but they need support from flows and positioning to force a breakout.

Sponsored

Whales Re-Accumulate as Selling Pressure Collapses

On-chain data shows why downside pressure has eased. Between January 11 and January 12, large wallets briefly reduced exposure, with whale holdings slipping from about 42.63 billion XCN to 42.49 billion. That distribution aligned closely with the trend-line rejection.

Since then, behavior has flipped. Over the past 24 hours, whales increased holdings again to roughly 42.53 billion XCN, signaling re-accumulation near support rather than continued distribution.

Sponsored

Even more important is exchange flow data. Daily exchange inflows, which track how many tokens are sent to exchanges and often act as a proxy for selling pressure, have collapsed. Inflows fell from roughly 440 million XCN to just 33 million in two days. That is a drop of over 90%, showing that potential sell-side pressure has dried up sharply.

This decline happened even during the brief whale sell-off, suggesting retail selling never accelerated. With fewer tokens heading to exchanges, the market looks increasingly primed for an XCN price expansion rather than a grind lower.

Sponsored

Onyxcoin Price Levels That Decide a 38% Breakout?

The final decision now rests on price. Onyxcoin price is still trading above its key exponential moving averages (EMAs). An EMA gives more weight to recent prices and helps identify trend direction. On the 12-hour chart, XCN remains above the 20-EMA, while the 50-EMA is moving closer to the 200-EMA, setting up a potential golden crossover if the price holds.

For bulls, the first trigger sits near $0.0093. A move above this level would signal a clean wedge breakout attempt. Strong confirmation comes above $0.0098, which would open the path toward the projected target near $0.0124, roughly 38% higher.

Risk remains clearly defined. A loss of the 20-EMA followed by a break below $0.0077 would invalidate the bullish setup and expose deeper downside, potentially toward the $0.0041 area if market conditions weaken.

For now, the setup is balanced. Selling pressure has collapsed, whales are back on the buy side, and structure remains bullish. Whether Onyxcoin price turns this into another breakout depends on one thing only: bulls must reclaim resistance before momentum fades again.

Kommentar hinterlassen