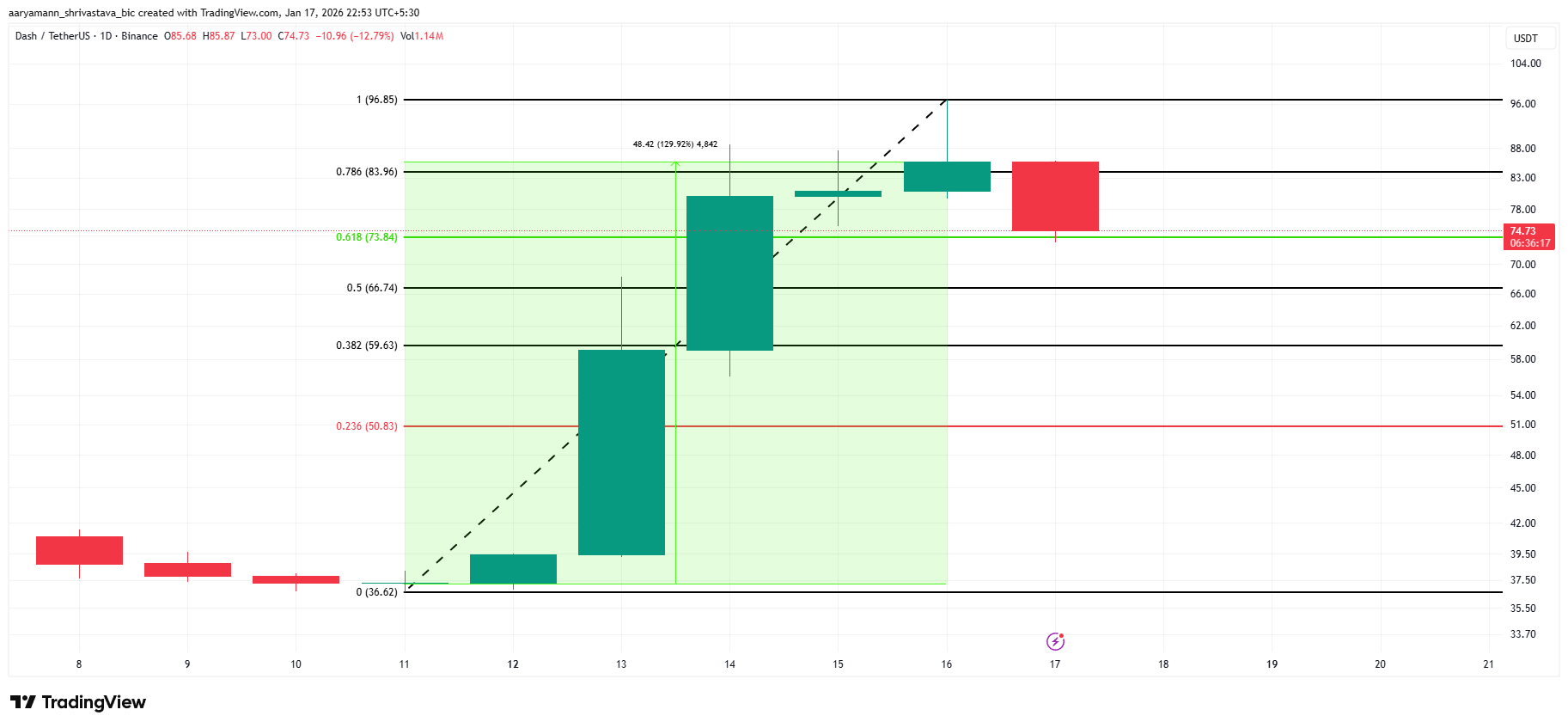

DASH price surged nearly 130% in a short span, fueling expectations of a sustained move above $100. The rally briefly pushed the privacy-focused cryptocurrency into triple digits during intraday trading.

However, the breakout failed, and selling pressure quickly followed, increasing the risk of a deeper correction.

Sponsored

Sponsored

Dash Holders Have Been Withdrawing

Market sentiment had already shown signs of weakness before the recent pullback. The Chaikin Money Flow indicator signaled a bearish divergence days ahead of the decline. While DASH price continued forming higher highs, CMF printed higher lows, highlighting weakening capital support behind the rally.

This pattern often reflects hype-driven price action rather than volume-backed strength. Capital outflows increased even as prices rose, suggesting distribution by informed participants.

When momentum lacks sustained inflows, rallies tend to unwind. DASH now faces the consequences of that imbalance as selling pressure accelerates.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sponsored

Sponsored

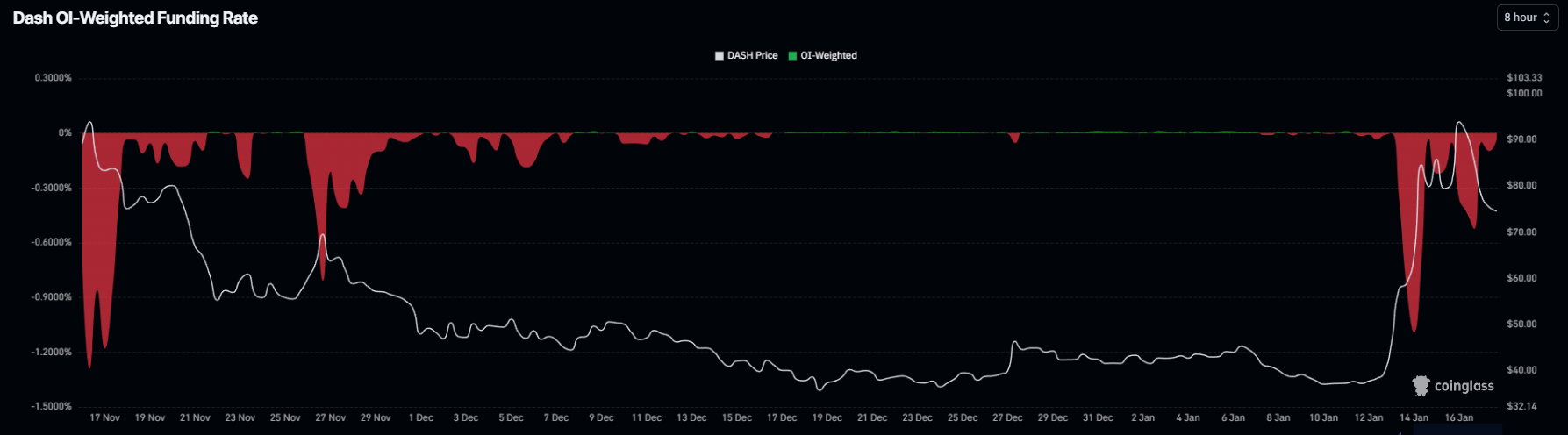

Macro indicators further confirm bearish expectations among traders. DASH’s funding rate data shows short positions dominating long contracts for nearly a week. This imbalance indicates traders anticipated downside and positioned accordingly before the recent reversal. As a result, these bears will likely observe considerable gains.

Such persistent negative funding reflects declining bullish conviction. As bearish positions gain validation, short-term sentiment weakens further. This dynamic discourages dip buying and increases downside momentum, especially when broader market conditions remain uncertain and risk appetite stays muted.

DASH Price Has A Lot To Lose

DASH rallied nearly 130% over the past week, touching $96 during Friday’s intraday high. The altcoin then dropped about 12%, trading near $74 at the time of writing. Price is currently holding above the 61.8% Fibonacci retracement level near $73.

This level, often called the bull market support floor, is critical for trend continuation. A breakdown would confirm a shift toward a bearish structure. Given prevailing indicators, DASH could slip toward $60. The 23.6% Fibonacci level near $50 would then become the next downside target.

The bearish outlook would weaken if DASH rebounds from the 61.8% retracement. Reduced selling and stronger holder conviction could stabilize the price. A move above the $83 resistance would signal renewed strength, opening the path for DASH to retest the $100 level once more.

Kommentar hinterlassen