Nearly $3 billion worth of Bitcoin and Ethereum options are set to expire on January 16. This puts derivatives markets in focus just as crypto prices test the strength of a recent rally.

While Bitcoin has pushed decisively above a key technical resistance level, options positioning and volatility metrics suggest traders remain cautious about declaring the move a confirmed bull breakout.

Sponsored

Options Expiry Puts Bitcoin’s Breakout to the Test

According to Deribit data, the total notional value of options expiring today is roughly $2.84 billion. Bitcoin dominates the expiry, accounting for approximately $2.4 billion, while Ethereum contributes around $437 million.

The imbalance highlights where market attention, as well as risk, is currently concentrated.

Bitcoin is trading near $95,310, notably above its max pain level of $92,000. In options markets, max pain refers to the price at which the most contracts expire worthless, often acting as a gravitational level into expiry.

Trading well above that threshold raises the probability of heightened volatility as positions are closed, rolled, or hedged.

Despite the breakout, Bitcoin’s options positioning remains defensive. Call open interest stands at 11,170 contracts, while put open interest is 14,050, resulting in a put-to-call ratio of 1.26.

Sponsored

This skew suggests that downside protection still outweighs bullish leverage, even after BTC broke out of its nearly two-month consolidation range.

If the Bitcoin price manages a daily candlestick close above $94,304, this retest would provide the jumping-off point for further upside, bringing $100,000 into focus. However, if this support breaks, the price could fall back into the multi-month consolidation range.

Ethereum Options Signal Caution as ETH Remains Range-Bound

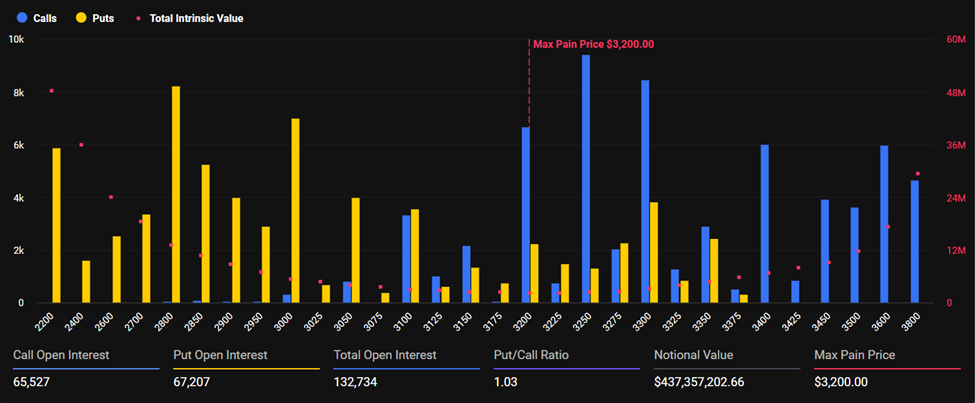

Ethereum, by contrast, continues to show signs of consolidation rather than trend acceleration. ETH is trading around $3,295, only marginally above its $3,200 max pain level.

Sponsored

Its options market appears more balanced, with 65,527 call contracts and 67,207 put contracts outstanding, resulting in a near-neutral put-to-call ratio of 1.03.

The data reflects a market that is hedged but undecided, consistent with Ethereum’s ongoing struggle to break cleanly above the $3,400 resistance zone.

Meanwhile, derivatives flow data further highlights Bitcoin’s dominance in the current rally. In a January 14 market note, analysts at Greeks.live highlighted a sharp divergence in block trade activity between the two assets.

Sponsored

“Bitcoin successfully broke through the $95,000 resistance level, breaking out of its nearly two-month consolidation range,” the analysts said. “Ethereum saw a larger percentage gain but its price action was less robust than BTC’s, remaining within its $3,400 consolidation range.”

That divergence was especially evident in institutional-sized trades. According to Greeks.live, Bitcoin block trades reached $1.7 billion, accounting for more than 40% of total daily volume. Meanwhile, Ethereum block trades totaled just $130 million, or about 20% of ETH’s volume.

“The market is clearly more concentrated on Bitcoin’s bullish momentum,” the analysts noted.

However, the broader derivatives backdrop remains less convincing. Greeks.live noted that futures volume failed to expand meaningfully alongside the price surge, and that implied volatility for major expiries did not rebound substantially.

“The derivatives market has not yet entered a structurally bullish phase,” the analysts said, adding that the current setup appears “more like a reactive response to the sudden surge, with the long-term outlook still not shifting toward a bull market.”

As today’s large options expiry clears, spot prices could gravitate toward their max pain levels and investors should brace for possible volatility. However, things tend to cool down afterwards as traders adjust to new trading environments.

Kommentar hinterlassen