XRP price has faced a sharp pullback in recent sessions, triggering a wave of panic selling across the market. The decline intensified bearish sentiment as investors rushed to limit losses.

However, this aggressive sell-off has pushed XRP into oversold territory, a condition that often attracts dip buyers seeking short-term recovery opportunities.

XRP Holders Sell To Prevent Losses

On-chain profit-to-loss volume data shows that losses have dominated XRP trading activity over the past 20 days. Many investors initially sold during brief price upticks, hoping to exit positions closer to break-even. As the downtrend persisted, selling pressure increased to avoid deeper drawdowns.

Sponsored

Sponsored

Over the past week, loss-driven selling accelerated further. A large portion of XRP transfers occurred below investors’ cost bases, reflecting fear rather than strategic repositioning. Historically, such conditions indicate capitulation phases, where weaker hands exit the market, which is the likely case with XRP right now.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Money Flow Index, which tracks buying and selling pressure using price and volume, has slipped into oversold territory within the last 24 hours. This signals that selling intensity may be reaching exhaustion.

Similar oversold readings in the past have created tactical entry points for buyers. When panic selling peaks, value-oriented participants often step in to accumulate. While this does not guarantee a trend reversal for XRP, it frequently supports short-term price bounces as supply pressure eases and demand stabilizes.

XRP Price Can Recover Recent Losses

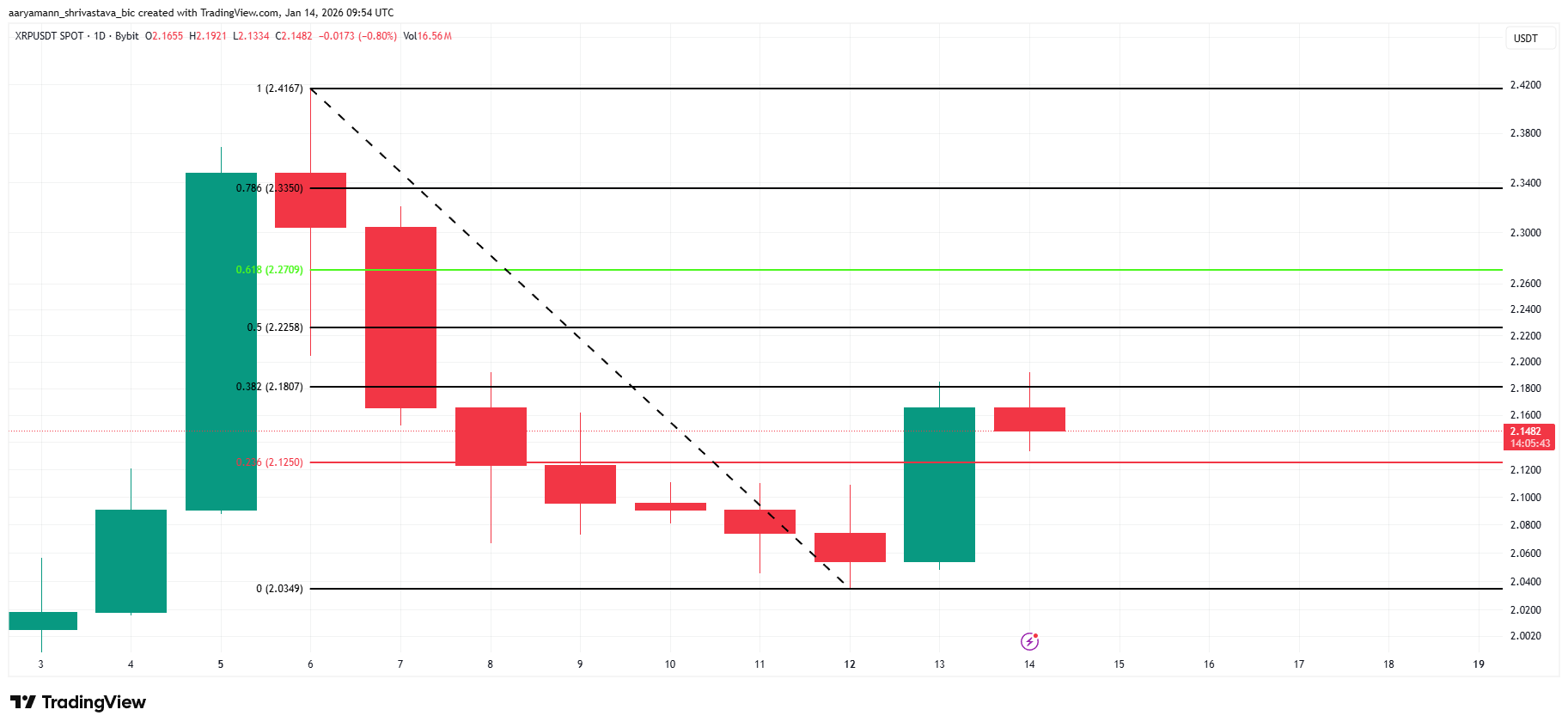

XRP trades near $2.14 at the time of writing, showing early signs of short-term recovery. Fibonacci retracement levels drawn from the recent swing high to the swing low provide important reference zones. The current structure suggests buyers are attempting to regain control following the oversold signal.

The altcoin has already established support above the 23.6% Fibonacci level. Holding this zone strengthens the recovery outlook. A confirmed bullish shift would require XRP to flip the 61.8% Fibonacci level near $2.27 into support. Achieving that would open a path toward $2.41, helping recoup recent losses.

Downside risks remain if support weakens. Failure to hold the 23.6% Fibonacci level would expose XRP to renewed selling. In that scenario, the price could retreat to $2.03. Losing that level would likely push XRP below the $2.00 psychological support, extending the decline and invalidating the bullish thesis.

Kommentar hinterlassen