After facing challenges last week, Bitcoin (BTC) has regained strength, igniting optimism among derivatives traders. Bullish positioning has increased sharply, pushing key indicators to notable highs.

However, predominantly negative exchange-traded fund (ETF) flows and weakening institutional demand are fueling concerns over elevated long-liquidation risk.

Sponsored

Sponsored

Bitcoin Derivatives Turn Bullish Despite Soft Spot Demand

Bitcoin opened 2026 with strong upside momentum, gaining more than 7% in the first five days of January. Nonetheless, a correction briefly pushed the asset below $90,000 late last week.

Since Sunday, Bitcoin has stabilized and returned to positive territory, trading mostly in the green amid relatively subdued volatility. At the time of writing, Bitcoin traded at $91,299, down 0.81% over the past 24 hours.

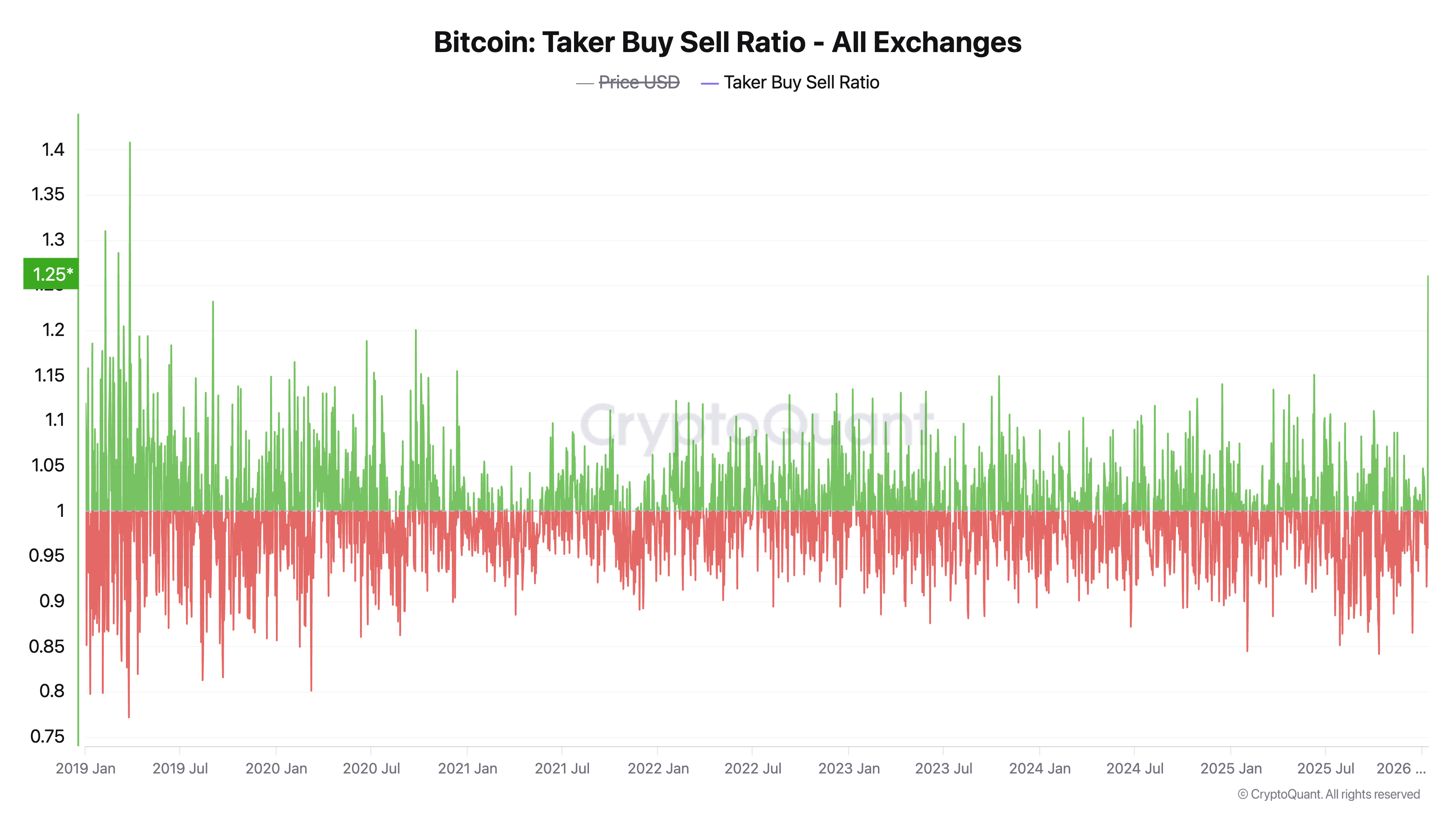

The rebound has sparked bullish sentiment in the derivatives market. Data from CryptoQuant revealed that the Taker Buy/Sell Ratio climbed to 1.249 today. This is the highest level since early 2019.

For context, the Taker Buy/Sell Ratio measures the balance between aggressive buying and selling in the derivatives market by comparing the volume of buy and sell orders executed at market price. A ratio above 1 indicates that bullish sentiment is dominating. Additionally, a ratio below 1 signals stronger bearish sentiment.

Sponsored

Sponsored

The surge in aggressive buying coincides with unusually elevated long exposure among top traders. Joao Wedson, founder of Alphractal, noted that long positions held by large traders have reached their highest level on record.

Such concentration of leverage on one side of the market can increase the likelihood of sharp, liquidation-driven price moves.

“This partially explains the liquidity hunts carried out by exchanges, driven by high-capital traders. Exchanges don’t really care about retail traders — what they want are wealthy traders positioned in the wrong direction,” Wedson wrote.

Additional market indicators reinforce concerns around elevated long risk. Data from SoSoValue showed unstable ETF demand. While the funds saw strong inflows at the beginning of the month, they reversed shortly after, with $681.01 million exiting the funds last week. Still, the ETFs pulled in $187.33 million on Monday.

“With an average realized price around $86,000, the majority of ETF inflows that entered since the October 2025 ATH are now sitting at a loss. More than $6 billion has exited spot Bitcoin ETFs over the same period, marking an all-time record since their approval,” analyst Darkfost stated. ” With Bitcoin liquidity remaining periodically thin, the impact of ETFs becomes even more significant, making it essential to keep a close eye on ETF flows.”

At the same time, the Coinbase premium has turned negative, showing that US-based spot buying pressure is lagging behind global markets.

Taken together, the data paint a picture of a market that is increasingly driven by leveraged speculation rather than spot demand. While derivatives traders are positioning aggressively for upside, institutional participation via ETFs remains inconsistent, and US spot buying pressure is weakening.

This leaves Bitcoin vulnerable to downside volatility. Crowded long positions may quickly unwind if price momentum stalls. Under such conditions, even modest corrections risk triggering liquidation cascades, potentially amplifying losses before more sustainable demand returns to the market.

Kommentar hinterlassen