Zcash price has moved sideways over the past several days, consolidating after recent volatility. While this pause may appear bearish, it often signals strength following an uptrend.

Price stability near current levels suggests buyers are defending positions, and recent investor behavior further supports a constructive outlook for ZEC.

Sponsored

Sponsored

Zcash Holders Are Buying

Exchange data shows a sharp reduction in available ZEC supply. According to Nansen, Zcash holdings on centralized exchanges dropped by 20.75% in the last 24 hours. Such a decline indicates significant outflows, which usually reflect investor accumulation rather than distribution.

When coins move off exchanges, selling pressure often decreases. Investors tend to transfer assets into private wallets when expecting higher prices. This behavior suggests rising confidence among ZEC holders, who appear willing to hold rather than liquidate at current levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sustained exchange outflows often precede upward price moves. Reduced liquid supply can amplify price reactions once demand increases. In Zcash’s case, this accumulation trend strengthens the bullish narrative forming around its current consolidation phase.

Sponsored

Sponsored

ZEC Traders Turn Bullish As Well

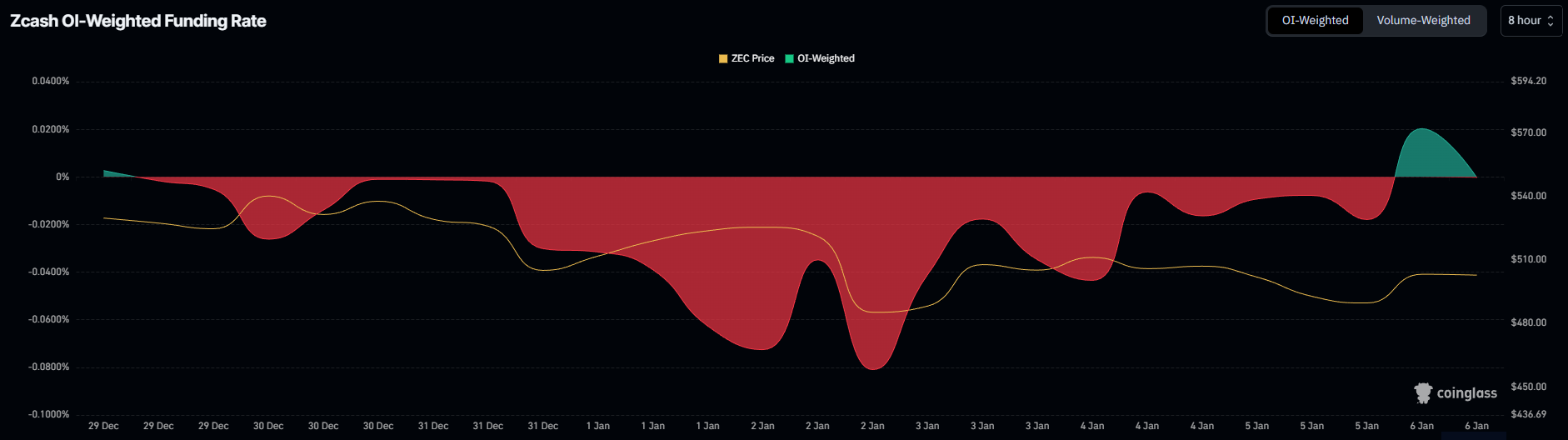

Derivatives market data shows a notable shift in trader positioning. For nine consecutive days, ZEC futures were dominated by short contracts. This imbalance kept the funding rate negative, reflecting bearish expectations among leveraged traders.

Over the last 24 hours, that trend reversed. Funding rates turned positive, indicating long contracts now outweigh shorts. This change suggests traders are positioning for upside rather than further downside.

Positive funding reflects improving sentiment and willingness to pay a premium to stay long. When futures sentiment aligns with spot accumulation, momentum often accelerates. This alignment supports the view that ZEC may be preparing for a directional move higher.

ZEC Price Eyes Breakout

ZEC trades near $512 at the time of writing, moving within an ascending wedge pattern. This structure typically resolves with a breakout. A successful move above resistance could drive price nearly 38% higher, targeting the $802 level.

Breakout odds are improving after ZEC recently tested and bounced from the lower trend line. Technical support held firmly, reinforcing buyer control. Accumulation and improving futures sentiment further increase the likelihood of continuation. A confirmed breakout requires flipping $600 into support.

Downside risk remains if sentiment shifts abruptly. Renewed selling or a failed breakout could pressure the price lower. A drop below $500 would weaken the structure. Under such conditions, the Zcash price may fall toward $442, invalidating the bullish thesis.

Kommentar hinterlassen