XRP reserves on centralized exchanges (CEX) fell sharply in 2025, dropping from roughly 4 billion tokens at the start of the year to around 1.6–1.7 billion by December. This marks the lowest levels since 2018, prompting speculation over whether a supply shock could emerge in 2026.

However, analysts caution that low exchange balances alone may not translate into immediate price pressure or a sustained rally.

Sponsored

XRP Exchange Reserve Decline in Historical Context

Data from Glassnode shows XRP exchange holdings falling from 3.76 billion on October 8, 2025, to 1.6 billion by late December, triggering discussion of potential short-term scarcity.

The sharp reduction coincided with Ripple’s routine release of 1 billion XRP from escrow on January 1, 2026.

However, historical trends suggest that declines in exchange reserves do not automatically lead to price surges.

In late 2018, XRP reserves were at similar lows, yet prices continued to trend downward. Likewise, at the end of 2022, a significant reserve drop failed to trigger a rally until late 2024.

Sponsored

“While attention stays on price, the real change is happening in the background… liquidity is being removed. The market becomes thinner, more sensitive, and far more reactive to demand,” said Web3Niels, a market analyst.

In other words, reduced exchange supply mainly eases short-term selling pressure rather than creating new demand.

Data Coverage and Exchange Reporting Limitations

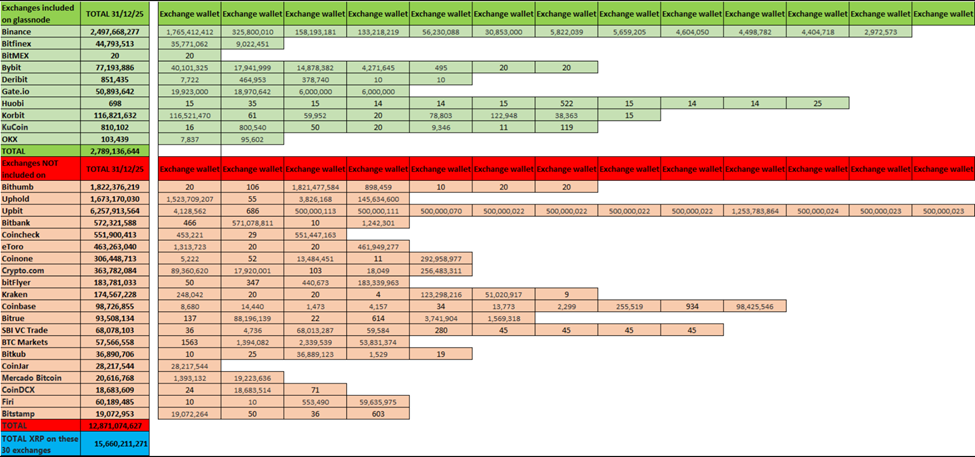

The supply shock narrative has faced additional scrutiny due to the incompleteness of the data. Popular on-chain analytics provider Glassnode tracks roughly ten exchanges. Still, analyst Leonidas expanded the coverage to 30 platforms, finding approximately 14 billion XRP held across exchanges in late 2025. This is significantly higher than the 1.6 billion figure often cited.

Sponsored

“Glassnode’s chart only shows data from 10 exchanges, and only from wallets they’ve linked to those exchanges… Gathering data from more exchanges, especially the ones holding billions of XRP, would better reflect reality and any possible trends,” wrote Leonidas.

This discrepancy highlights the challenge of relying on limited exchange data. XRP’s high liquidity means tokens can be quickly moved on and off platforms, making static reserve numbers less reliable as predictors of market behavior.

“XRP listed on orderbooks for sale is dynamic… sometimes $10M buying can push price higher and sometimes $100M buying doesn’t stop price from going down,” wrote analyst Vet_X0.

Sponsored

Ripple’s monthly escrow release adds another layer to the narrative. On January 1, 2026, Ripple unlocked 1 billion XRP, of which only about 200–300 million entered circulation due to routine relocking of 60–80%.

With the release fully anticipated, market participants largely viewed it as a “non-event,” unlikely to drive dramatic price changes.

Factors such as XRP ETF inflows, institutional adoption, and US regulatory developments, particularly the upcoming CLARITY Act, may influence XRP demand more significantly than fluctuations in exchange reserves.

While XRP reserves are at 8-year lows, the overall supply picture remains dynamic, and any potential 2026 supply shock is far from guaranteed.

Kommentar hinterlassen