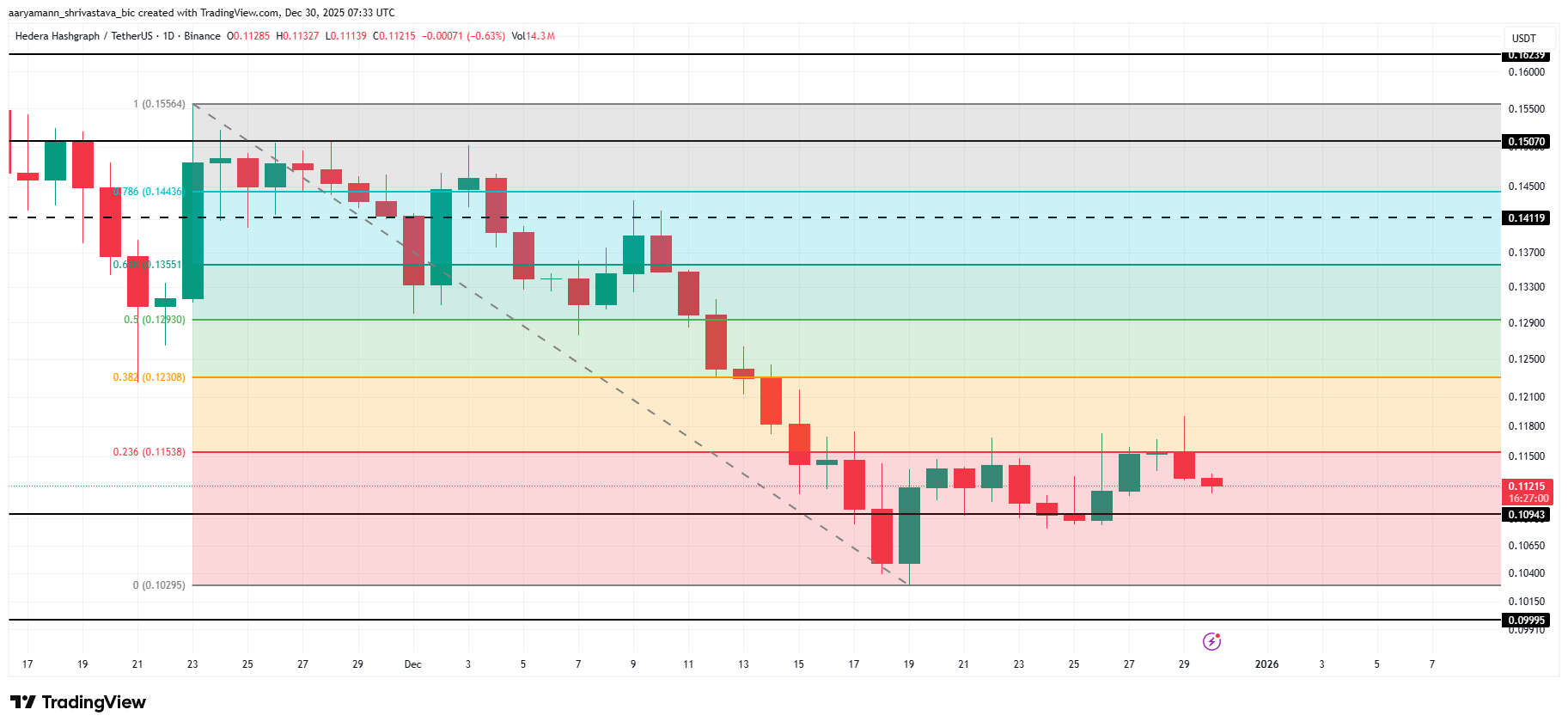

Hedera has attempted a modest recovery in recent sessions, yet HBAR remains capped below a key technical barrier. The altcoin continues to trade under the 23.6% Fibonacci Retracement level, limiting upside momentum.

While Hedera is preparing structural changes for 2026, investors remain focused on whether these developments can meaningfully influence HBAR price performance.

Sponsored

Sponsored

Hedera Hikes Its Service Fee

Hedera announced in July that it will increase its ConsensusSubmitMessage transaction fee by 800% starting January 2026. The fee will rise from $0.0001 to $0.0008. ConsensusSubmitMessage transactions allow users to submit data to the Hedera network for trusted timestamping and ordering.

Despite the magnitude of the percentage increase, the absolute cost remains minimal. Industry participants have debated the precedent of higher network fees, yet the change is unlikely to materially affect demand. The fee adjustment primarily targets enterprise use cases and does not significantly alter the cost structure for most applications or users.

Hedera Holders Are More Bearish Than Bullish

Technical indicators reflect a cautious to bearish investor outlook. The Chaikin Money Flow, or CMF, remains well below the zero line, signaling sustained capital outflows from HBAR. This suggests that investors are reducing exposure rather than positioning for a recovery.

The absence of strong bullish macro signals has reinforced this trend. Risk appetite across altcoins remains muted, and HBAR has not attracted consistent inflows. Given current conditions, this bearish capital flow dynamic is likely to persist into 2026 unless broader sentiment improves materially.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sponsored

Sponsored

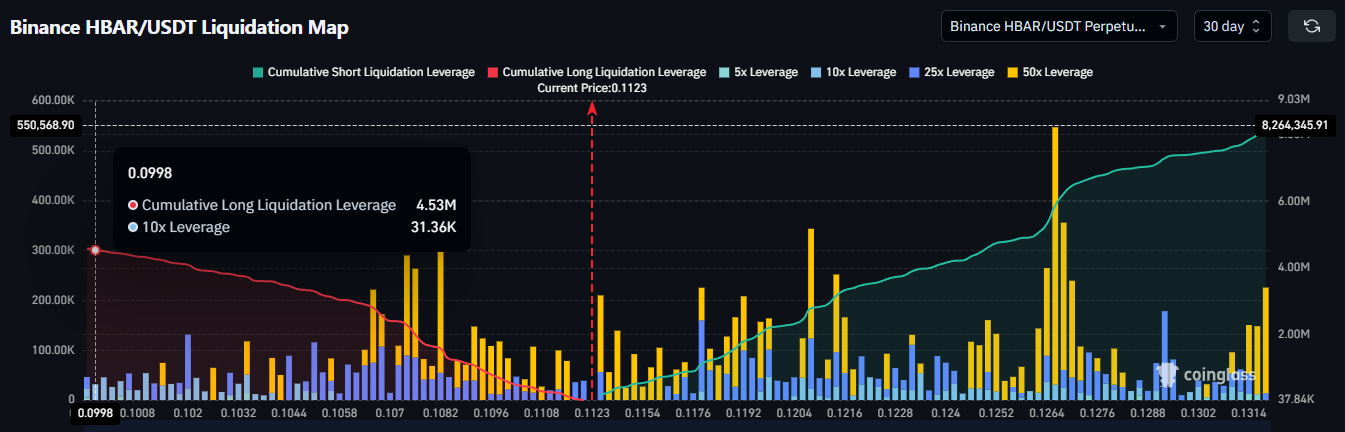

Derivatives data further highlights weak macro momentum. The liquidation map shows that traders are positioning for downside risk. Short exposure in HBAR currently stands near $8.21 million, while long exposure is significantly lower at approximately $4.5 million.

This imbalance indicates that bearish contracts dominate market positioning. Traders appear more confident in a potential price decline than a sustained rebound. Such skewed positioning often amplifies downside volatility, especially during periods of low liquidity or negative market catalysts.

HBAR Price Needs To Flip This Critical Level Into Support

HBAR trades at $0.112 at the time of writing, holding above the immediate $0.109 support level. However, price remains constrained below the 23.6% Fibonacci Retracement line near $0.115. This confluence continues to act as a strong resistance zone, limiting upward progress.

The prevailing technical and on-chain signals suggest that any recovery attempt will likely remain shallow. Consolidation above $0.109 appears more probable than a decisive breakout for HBAR. This range-bound behavior reflects weak demand and limited speculative interest under current market conditions.

A shift in the broader cryptocurrency market could alter this outlook. If macro conditions turn decisively bullish, HBAR may benefit from renewed risk appetite. Flipping the 23.6% Fibonacci level into support would confirm a recovery move, opening a potential path toward $0.120.

Kommentar hinterlassen