The ETH price could be gearing up for a major recovery from downtrends as the Ethereum network shows renewed signs of strength. On-chain data shows that validator deposits have once again outpaced exits, even after months of higher withdrawal activity, reflecting improved sentiment among holders. Notably, the change is being closely watched as a potential catalyst that could tighten supply and support a move towards or above the $4,000 level.

Ethereum Staking Deposits Overtake Withdrawals

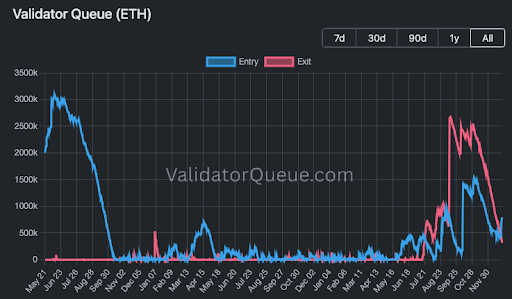

Ethereum is seeing a notable shift in staking activity as validator deposits have surpassed withdrawals for the first time in six months. Validator entry queues have surged to more than twice the size of exit queues, pointing to renewed demand for staking and growing confidence among institutional partners and ETH long-term holders.

Data from ValidatorQueue shows that Ethereum’s validator entry queue has climbed to roughly 788,310 ETH, at the time of writing. At current prices, this represents about $2.3 billion in value and comes with an estimated wait time of 13 days and 16 hours to activate new validators. By contrast, ETH’s validator exit queue remains significantly smaller, standing at around 312,091, valued at approximately $916,923, as of writing.

Notably, the current level represents the highest ETH volume queued for staking since late November. A surge in staking inflows above withdrawals has also been frequently associated with bullish price action for Ethereum.

Meanwhile, treasury buyers have played a significant role in this increase in validator entry queues, with Ethereum-focused firm Bitmine leading the way. Data from LookOnChain reveals that the crypto company staked 342,560 ETH on December 28, valued at roughly $1 billion. Bitmine’s staking activity comes as it prepares to launch its Made in America Validator Network (MAVAN) in 2026. Such large-scale staking by treasury firms typically reduces ETH’s liquid supply, which, in turn, can support higher prices.

Beyond treasury companies, Ethereum’s broader network participation is also rising. ValidatorQueue reports that there are now more than 983,060 active validators on the blockchain, representing approximately 29.29% of the total supply, or around 35.5 million ETH, currently staked. Moreover, the Ethereum Pectra upgrade has improved users’ staking experience and raised maximum validator limits, making restating easier for large balances.

How This Could Push ETH Price Past $4,000

Historically, periods when the Ethereum validator entry queue exceeds the exit queue have often preceded major ETH price rallies. Analysts note that the last time staking deposits surpassed withdrawals, in June 2025, Ethereum’s price had doubled over a short span.

If history repeats itself, the cryptocurrency could experience another sharp rally in 2026. From its current price of above $2,930, a continuation of trends could push it well above $4,000. Analysts also confirm that ETH is currently testing the $3,000 level, and a strong bounce from this zone could open the path toward $4,000.

Featured image created with Dall.E, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Kommentar hinterlassen