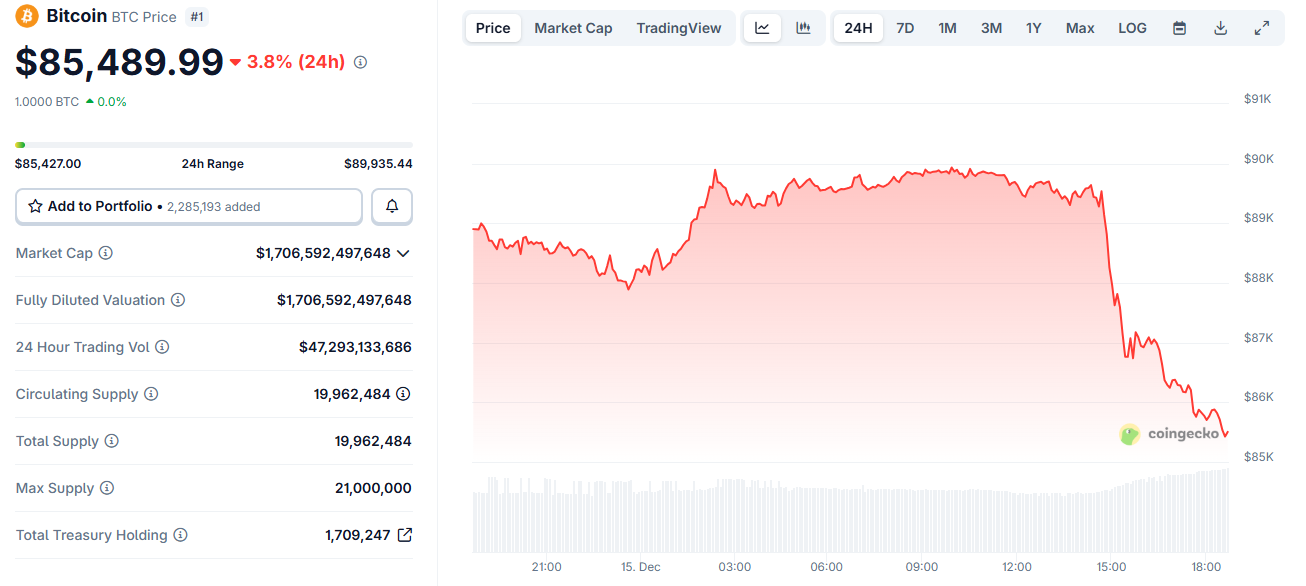

Bitcoin slid to the $85,000 level on December 15, extending its recent decline as global macro risks, leverage unwinding, and thin liquidity collided. The drop erased more than $100 billion from the total crypto market cap in just days, raising questions about whether the sell-off has finished.

While no single catalyst caused the move, five overlapping forces pushed Bitcoin lower and could keep pressure on prices in the near term.

Bank of Japan Rate Hike Fears Triggered Global De-Risking

The biggest macro driver came from Japan. Markets moved ahead of a widely expected Bank of Japan rate hike later this week, which would take Japanese policy rates to levels unseen in decades.

Sponsored

Sponsored

Even a modest hike matters because Japan has long fueled global risk markets through the yen carry trade.

For years, investors borrowed cheap yen to buy higher-risk assets such as equities and crypto. As Japanese rates rise, that trade unwinds. Investors sell risk assets to repay yen liabilities.

Bitcoin has reacted sharply to previous BOJ hikes. In the last three instances, BTC fell between 20% and 30% in the weeks that followed. Traders began pricing in that historical pattern before the decision, pushing Bitcoin lower in advance.

US Economic Data Reintroduces Policy Uncertainty

At the same time, traders pulled back risk ahead of a dense slate of US macro data, including inflation and labor market figures.

The Federal Reserve recently cut rates, but officials signaled caution about the pace of future easing. That uncertainty matters for Bitcoin, which has increasingly traded as a liquidity-sensitive macro asset rather than a standalone hedge.

With inflation still above target and jobs data expected to weaken, markets struggled to price the Fed’s next move. That hesitation reduced speculative demand and encouraged short-term traders to step aside.

As a result, Bitcoin lost momentum just as it approached key technical levels.

Sponsored

Sponsored

Heavy Leverage Liquidations Accelerated the Decline

Once Bitcoin broke below $90,000, forced selling took over.

More than $200 million in leveraged long positions were liquidated within hours, according to derivatives data. Long traders had crowded into bullish bets after the Fed’s rate cut earlier this month.

When prices slipped, liquidation engines sold Bitcoin automatically to cover losses. That selling pushed prices lower, triggering further liquidations in a feedback loop.

This mechanical effect explains why the move was fast and sharp rather than gradual.

Sponsored

Sponsored

Thin Weekend Liquidity Magnified Price Swings

The timing of the sell-off made it worse.

Bitcoin broke down during thin weekend trading, when liquidity is typically lower and order books are shallow. In those conditions, relatively small sell orders can move prices aggressively.

Large holders and derivatives desks reduced exposure into low liquidity, amplifying volatility. That dynamic helped pull Bitcoin from the low-$90,000 range toward $85,000 in a short window.

Weekend breakdowns often look dramatic even when broader fundamentals remain unchanged.

Wintermute’s Bitcoin Sales Added Spot-Market Pressure

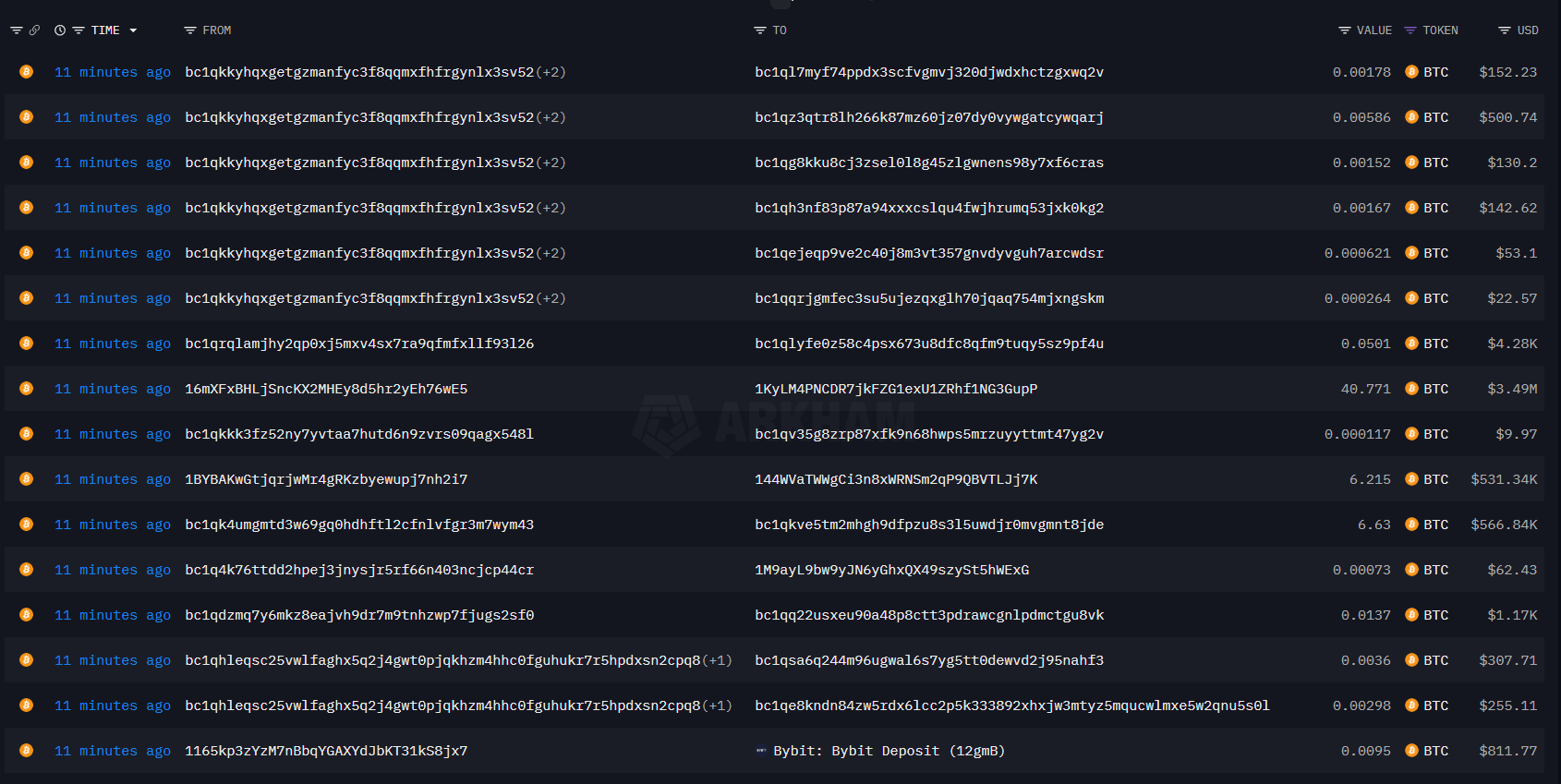

Market structure stress was compounded by significant selling from Wintermute, one of the crypto industry’s largest market makers.

Sponsored

Sponsored

During the sell-off, on-chain and market data showed Wintermute offloading a large amount of Bitcoin — estimated at over $1.5 billion worth — across centralized exchanges. The firm reportedly sold BTC to rebalance risk and cover exposure following recent volatility and losses in derivatives markets.

Because Wintermute provides liquidity across both spot and derivatives venues, its selling carried outsized impact.

The timing of the sales also mattered. Wintermute’s activity occurred during low-liquidity conditions, amplifying downside moves and accelerating Bitcoin’s slide toward $85,000.

What Happens Next?

Whether Bitcoin drops further now depends on macro follow-through, not crypto-specific news.

If the Bank of Japan confirms a rate hike and global yields rise, Bitcoin could remain under pressure as carry trades unwind further. A strong yen would add to that stress.

However, if markets fully price in the move and US data softens enough to revive rate-cut expectations, Bitcoin could stabilize after the liquidation phase ends.

For now, the December 15 sell-off reflects a macro-driven reset, not a structural failure of the crypto market — but volatility is unlikely to fade quickly.

Kommentar hinterlassen