Ethereum (ETH) is up nearly 9% over the past seven days, showing signs of strength, yet the price continues to struggle around the $2,000 mark. Despite this upward movement, key indicators suggest the market is still lacking decisive momentum.

From trend strength to whale activity and support/resistance levels, several metrics point to a market caught in consolidation. Whether Ethereum breaks out or breaks down from here may depend on how it reacts to both technical levels and shifting investor behavior in the days ahead.

Ethereum BBTrend Is Positive

Ethereum’s BBTrend is currently sitting at 3.23 and has remained in positive territory for the past three consecutive days. The indicator recently peaked at 3.93 on March 22, signaling a strengthening trend over the short term.

This sustained positive reading suggests that Ethereum may be gaining momentum again, though not aggressively.

Notably, the last time BBTrend reached above 5—a level typically associated with strong trending conditions—was on February 26, nearly a month ago. Since then, the indicator has shown moderate strength but has yet to break into the high-momentum zone again.

BBTrend, short for Bollinger Band Trend, is a technical indicator used to measure the strength of price trends. It quantifies how far the price deviates from its mean, typically using Bollinger Bands as a baseline.

Values below 0.5 often signal a lack of trend or choppy conditions, while readings above 1.0 indicate growing trend strength. A value above 3 is considered a sign of a solid trend, and anything over 5 typically points to a strong directional move, either bullish or bearish.

Ethereum’s BBTrend hovering at 3.23 suggests some directional conviction, but the absence of readings above 5 in the past month may imply that while ETH is trending, it’s not yet in a breakout or high-momentum phase.

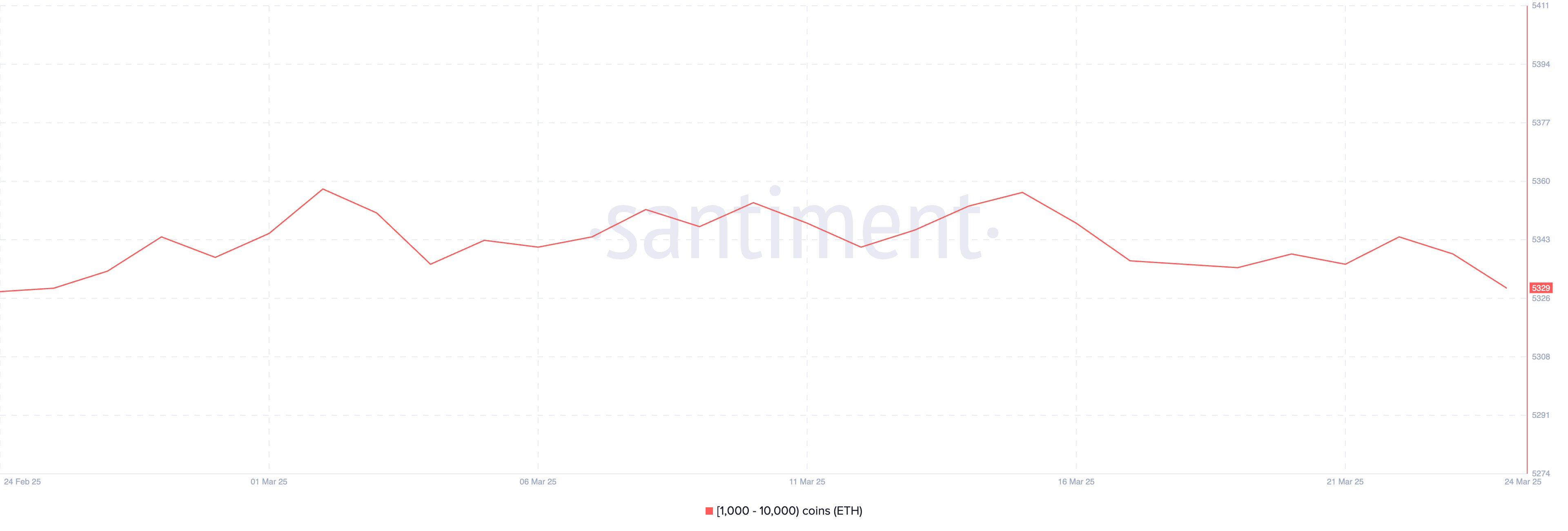

Whales Are Reaching A Month-Low

The number of Ethereum whales—wallets holding between 1,000 and 10,000 ETH—has dropped to 5,329, down from 5,344 just three days ago.

This slight but notable decline suggests a gradual reduction in large-holder confidence or positioning. What’s particularly important is that this is the lowest whale count observed since February 25, marking a one-month low.

While the change may appear small, even marginal movements in whale behavior can ripple through the broader market, especially when Ethereum’s trend indicators are showing only moderate strength.

Tracking Ethereum whale wallets is crucial because these large holders have the power to influence price through significant buying or selling activity.

Whales often act as smart money, and changes in their accumulation or distribution patterns can serve as early signals of broader market shifts. A declining whale count may imply that some high-capacity investors are taking profits, repositioning, or adopting a more cautious stance.

The fact that the number of whale wallets is now at a monthly low could suggest increasing hesitation at higher price levels, potentially capping upside momentum for ETH in the near term unless new inflows or investor confidence returns.

Will Ethereum Fall Below $2,000 Again?

Ethereum’s EMA lines currently suggest a phase of consolidation, with price action continuing to struggle around the $2,000 mark. The lack of clear direction reflects indecision in the market, as ETH trades within a narrowing range.

On the downside, if Ethereum price tests the key support level at $1,938 and fails to hold it, the next lower targets lie at $1,867 and potentially as far as $1,759.

On the flip side, if Ethereum manages to gather bullish momentum and build a sustained uptrend, the first major resistance to watch is at $2,320.

A successful breakout above this level could trigger a run toward $2,546 and, if the momentum accelerates, even reach as high as $2,855.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen