Amid ongoing market uncertainty, XRP, the native token of Ripple Labs, has also registered a price drop, similar to other major assets like Bitcoin (BTC) and Ethereum (ETH). However, it seems to be in control, and its price may not fall further.

On March 20, 2025, following sudden shifts in sentiment, the overall market declined notably. Amid this, XRP recorded a 4% price drop and has now reached a crucial level.

XRP Technical Analysis and Upcoming Levels

According to expert technical analysis, XRP has recently witnessed a bullish breakout from a cup and handle pattern, along with a descending triangle.

Due to the ongoing market decline, the asset has successfully retested the breakout area at the $2.40 level and is once again moving upward. However, this breakout area also aligns with the 200 Exponential Moving Average (EMA) on the four-hour time frame.

Based on recent price action and historical patterns, if the asset holds above the $2.38 level, there is still hope that XRP could soar significantly and potentially reach the $3.50 level. Meanwhile, if the asset fails to hold this level and closes a four-hour candle below $2.38, it could drop by 13% to reach $2.05 in the future.

Current Price Momentum

XRP is currently trading near $2.42 and has registered a price drop of over 4% in the past 24 hours. However, during the same period, due to bearish market sentiment, traders and investors participated less in the asset, causing a 20% decline in trading volume.

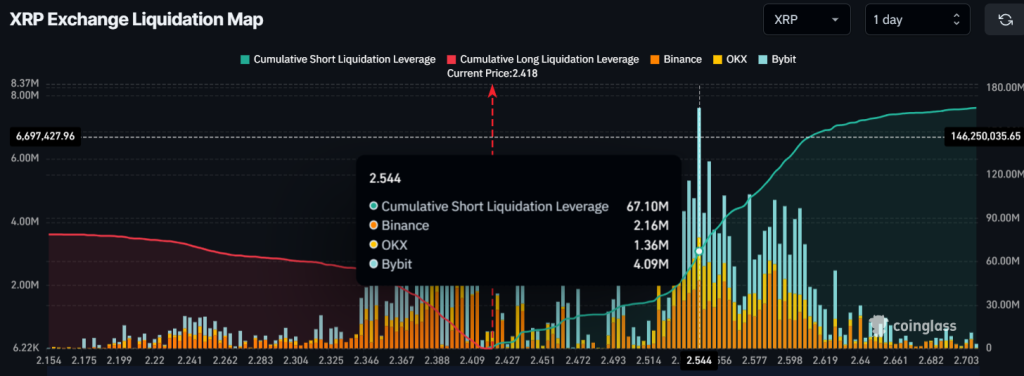

Traders’ $67 Million Worth Bets on Short Side

Despite the bullish breakout and ongoing price retest, intraday traders seem to be following the current market trend and are strongly betting on the short side, as reported by the on-chain analytics firm Coinglass.

Data reveals that traders are currently over-leveraged at $2.40, holding $26 million worth of long positions. Meanwhile, $2.54 is another over-leveraged level, where traders have placed $67 million worth of short positions. This clearly indicates that trader sentiment is bearish, and there is a strong possibility that the asset may consolidate near this level.

Kommentar hinterlassen