As the weekend approaches, the overall cryptocurrency market has begun to recover, showing signs of an upward rally. Amid this recovery, ADA, the native token of the Cardano blockchain, appears bullish and is poised for a significant rally in the coming days.

Cardano (ADA) Technical Analysis and Upcoming Levels

According to expert technical analysis, ADA has formed a bullish inverted head and shoulders pattern and is now on the verge of a breakout. Based on recent price momentum, if the asset breaches the pattern’s neckline and closes a four-hour candle above the $0.76 level, there is a strong possibility it could initially soar by 10% to reach $0.85 in the coming days.

However, amid this rally, ADA may face resistance from the 200 Exponential Moving Average (EMA), which currently indicates that the asset is in a downtrend. This bullish thesis will hold only if ADA breaches the $0.76 level, otherwise, the bullish outlook may fail.

However, on a longer time frame, ADA appears to be consolidating within a tight range between $0.73 and $0.757 over the past five trading days and is now attempting to break out. If the asset breaches this consolidation and closes a daily candle above the $0.76 level, it could soar significantly by 50% to reach $1.15 in the coming days.

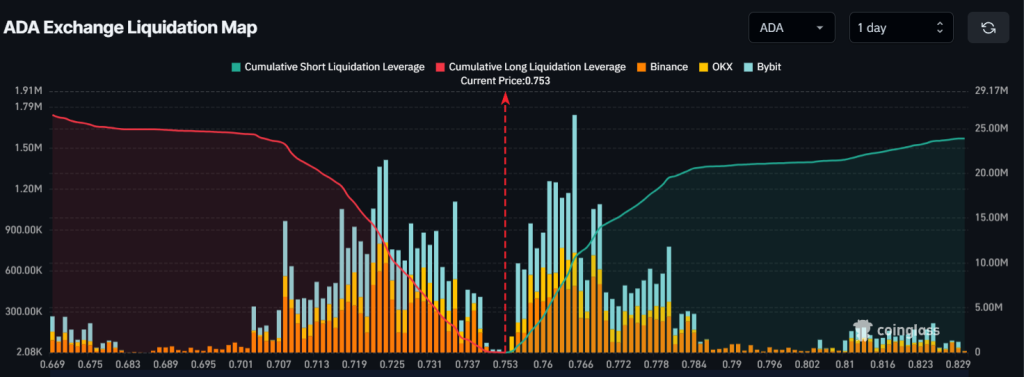

Major Liquidation Levels

At press time, both bulls and bears are making strong bets on the asset, as reported by the on-chain analytics firm Coinglass. Data reveals that traders are currently over-leveraged at $0.723 on the lower side, with $12 million worth of long positions.

Meanwhile, $0.765 is another over-leveraged level, where traders have held $10.50 million worth of ADA tokens.

Kommentar hinterlassen