Amid the ongoing market uncertainty, while the majority of cryptocurrencies are witnessing price recovery, Litecoin (LTC) is poised for a massive price drop. The potential reason for this bearish speculation is the formation of negative price action and traders’ bearish sentiment, as reported by the on-chain analytics firm Coinglass.

Current Price Momentum

LTC is currently trading near $127 and has experienced a price drop of over 6% in the past 24 hours. During the same period, its trading volume declined by 23% due to its bearish price momentum, indicating lower participation from traders and investors compared to previous days.

Litecoin (LTC) Technical Analysis and Price Prediction

According to expert technical analysis, LTC appears bearish as it has been moving within a parallel channel pattern between $95 and $141 since November 2024. Despite bearish market sentiment in the past few days, LTC’s price has surged nearly 38%, rising from $95 to $141. However, it is now experiencing selling pressure due to its history of price drops and the current market sentiment.

Based on historical patterns, if LTC fails to break above the $141 level, there is a strong possibility it could drop by 25% to reach the $95 support level. Currently, the asset is trading above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating that LTC is in an uptrend.

Mixed On-Chain Metrics

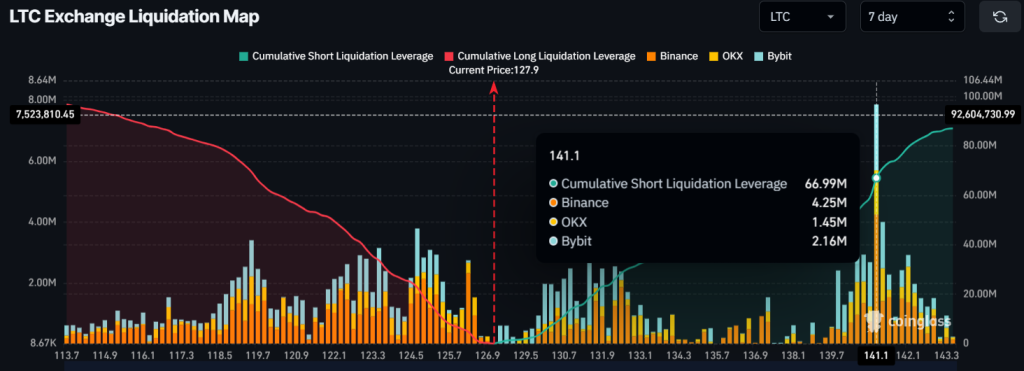

When examining the current market sentiment and price at the reversal level, intraday traders appear to be betting on the bearish side, as reported by the on-chain analytics firm Coinglass.

Data from the exchange liquidation map shows that traders betting on the short side are over-leveraged at the $141.5 level and have built $67 million worth of short positions in the past week. Meanwhile, traders betting on the long side seem exhausted, having built only $21 million worth of long positions.

These over-leveraged positions reflect the sentiment of both short and long traders, as some believe the price won’t break above that level. If it does, these positions will be liquidated.

Despite LTC’s bearish outlook, investors and long-term holders seem to be accumulating the token. Data from spot inflow/outflow reveals that exchanges have witnessed an outflow of $9.41 million worth of LTC tokens in the past 24 hours, indicating potential accumulation.

When combining these on-chain metrics with technical analysis, it appears that short-term players are bearish, expecting the price to decline in the coming days. Meanwhile, long-term holders seem to be taking advantage of the price drop and are significantly accumulating the token.

Kommentar hinterlassen