This week, the crypto market recorded several important developments, from US trade policies and token listings to blockchain and regulatory advancements. The highlights display how the global cryptocurrency ecosystem continues to advance.

The following is a roundup of crucial developments that happened this week but will continue shaping the sector.

Trump’s Tariffs Shake Global Markets

US President Donald Trump stirred the global trade market earlier this week, proposing tariffs against Canada, Mexico, and China. This new round of trade restrictions was aimed at protecting domestic industries.

Following the initial announcement, Canada and Mexico pushed back, leading to temporary delays in some tariff applications. Mexico, in particular, secured a short-term reprieve as both nations entered new negotiations with the US government.

“We had a good conversation with President Trump with great respect for our relationship and sovereignty; we reached a series of agreements. Our teams will begin working today on two fronts: security and trade. Tariffs will be paused for one month from now,” Mexican President Claudia Sheinbaum shared on X (Twitter).

Against this backdrop, analysts observed Bitcoin’s Coinbase Premium Index hitting a 2025 high, indicating increased demand in North America. Investors appear to be shifting toward Bitcoin as a hedge against possible economic instability caused by these trade policies.

Meanwhile, China retaliated, imposing a 10% tariff on US crude oil and agricultural machinery on its exports to the US. While this reignited fears of another prolonged trade war, some analysts argue that China’s latest tariffs may not have as severe an impact as initially feared.

UAE Taps Shiba Inu

BeInCrypto also reported the United Arab Emirates (UAE) is advancing its aggressive push toward becoming a global leader in Web3 adoption. This week, Shiba Inu (SHIB) was selected to integrate blockchain into various government services. The partnership will facilitate blockchain-based solutions across sectors, improving efficiency and security.

“By embracing emerging technologies, we aim to set a global benchmark for innovation, delivering transformative solutions that benefit both our citizens and the wider community,” His Excellency Eng Sharif Al Olama, Undersecretary for Energy and Petroleum Affairs at UAE’s Ministry of Energy and Infrastructure, stated.

Beyond this collaboration, the UAE remains one of the most crypto-friendly jurisdictions, reinforced by its tax exemption policy for digital asset firms. With no corporate tax levied on crypto businesses, the country attracts global blockchain firms and talent, positioning itself as a pivotal player in the digital economy.

The price of Shiba Inu briefly surged after the announcement. At press time, the meme coin was trading at $0.00001563.

Coinbase Mulls Two Altcoins for Listing

Coinbase, the largest US-based crypto exchange, added two new altcoins—Ether.fi (ETHFI) and Bittensor (TAO)—to its listing roadmap. Following the announcement, the tokens’ values surged by nearly 40%, reflecting the typical price action seen when assets gain visibility on major exchanges.

Historically, tokens listed on Coinbase or Binance exchange tend to witness significant price appreciation due to increased accessibility and liquidity. For example, Binance’s recent addition of AI-powered altcoins led to price spikes across the sector. Similarly, the TOSHI token soared upon the Coinbase listing announcement.

Cognizant of such turnouts, investors often monitor these listing announcements in a calculated attempt to capitalize on expected gains.

SEC Litigator Reassignment

The US Securities and Exchange Commission (SEC) recently reassigned one of its lead litigators to the agency’s IT department. What was surprising, however, was that litigator Jorge Tenreiro was pivotal in the high-profile Ripple (XRP) case.

Ripple has been in a legal battle with the SEC over classifying XRP as a security. The reassignment suggests a possible shift in regulatory focus. Specifically, it fueled speculation that the SEC might be stepping back from its aggressive approach toward XRP. It also meant a possible imminent end to the longstanding case.

Indeed, the commission has given several hints that it will drop the Ripple case. Most recently, the SEC completely removed the lawsuit from its website. Reassigning Tenreiro to a non-crypto-related role further suggests that the lawsuit might be coming to an end.

These changes follow the recent resignation of former SEC chair Gary Gensler. In his place, SEC commissioner Mark Uyeda stepped in as interim chair, potentially laying the groundwork for Paul Atkins.

UBS Brings Gold Trading to Blockchain

Adding to the list of interesting things that happened in crypto this week, UBS unveiled a new initiative. BeInCrypto reported that the Swiss banking giant integrated gold trading with blockchain technology.

The bank is leveraging Ethereum’s zkSync layer to facilitate secure and transparent gold transactions on the blockchain. This marks another significant step in traditional finance (TradFi) adopting decentralized ledger technology.

The move by UBS could enhance efficiency in gold markets. Specifically, it could provide a more accessible and verifiable means of trading the precious metal.

As more financial institutions explore blockchain for asset tokenization, Ethereum continues establishing itself as a preferred platform for institutional adoption.

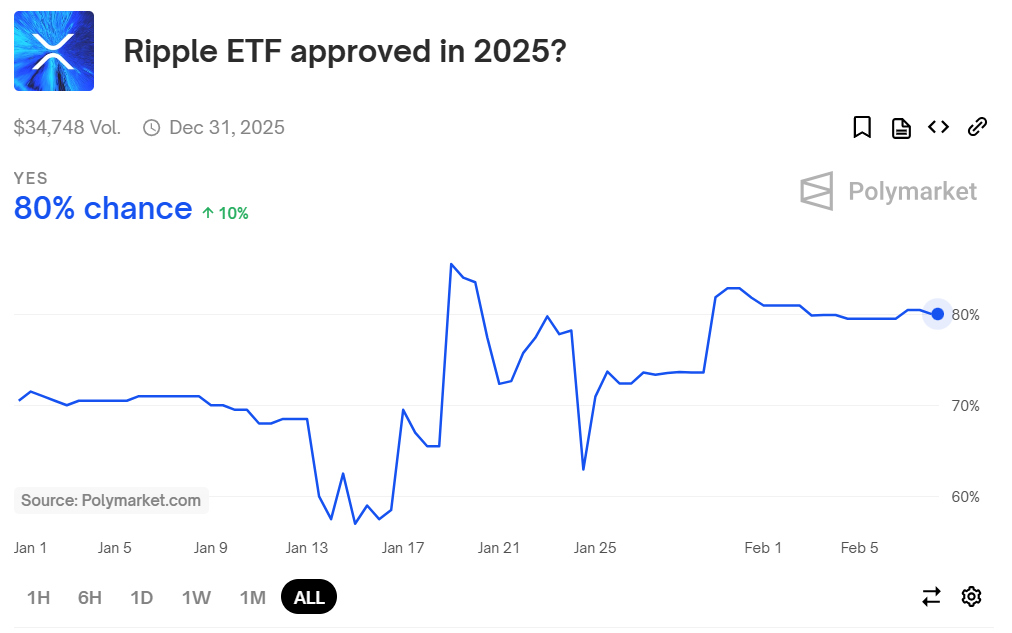

XRP ETF Eyes SEC Approval

In another major development for XRP, Cboe Global Markets filed a 19b-4 application with the SEC—the options exchange plans to launch an XRP-based exchange-traded fund (XRP ETF). If approved, this would mark a significant milestone for institutional adoption of XRP.

XRP ETF approval would provide investors with a regulated and convenient way to gain exposure to the asset, which could increase liquidity and price stability for the XRP token.

Given the ongoing legal battle between Ripple and the SEC, the approval process is expected to face scrutiny. Nevertheless, market participants remain optimistic about a favorable outcome following Gensler’s ouster.

On the prediction platform Polymarket, the likelihood of an XRP ETF receiving approval in 2025 has been strikingly high. The odds stood at a notable 80% at the time of this report.

MicroStrategy Rebrands to Strategy

MicroStrategy, one of the largest corporate holders of Bitcoin, rebranded itself this week, taking the moniker “Strategy.” The move aligns with its commitment to Bitcoin accumulation and adoption of blockchain technology.

“Strategy is one of the most powerful and positive words in the human language. It also represents a simplification of our company name to its most important, strategic core. After 35 years, our new brand perfectly represents our pursuit of perfection,” The firm’s executive chair, Michael Saylor, explained.

Under Michael Saylor’s leadership, the company has consistently increased its Bitcoin holdings, viewing it as a long-term asset. The rebranding reinforces its dedication to leveraging Bitcoin for corporate treasury management and institutional investment strategies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen