After an impressive price reversal, the crypto market once again seems to be facing a dip across various cryptocurrencies. Amid this, XRP, the native token of Ripple Labs, is gaining significant attention from crypto enthusiasts despite the continuous price decline, as reported by the on-chain analytics firm Coinglass.

Binance Traders’ Rising Bets on Long Positions

The on-chain metric Binance XRPUSDT Long/Short ratio currently stands at 2.80, indicating strong bullish sentiment among traders. However, this metric also reveals that for every 2.80 long positions, there is a single short position.

Additionally, the data further shows that, at press time, 73.6% of top XRP traders on Binance hold long positions, while 26.4% hold short positions.

Current Price Momentum

However, all this interest from Binance traders comes while XRP is struggling to gain momentum. The asset is currently trading near $2.50 and has experienced a price drop of over 6.50% in the past 24 hours.

Due to this market uncertainty, traders’ and investors’ participation has dropped, resulting in a 65% decline in its trading volume.

XRP Price Action and Key Levels

With this notable price decline, XRP seems to be failing to hold its crucial support level of $2.60, which it achieved during the significant price reversal.

Based on the recent price action and historical momentum, if XRP doesn’t rebound and closes a daily candle below the $2.50 level, there is a strong possibility it could fall by 25% to reach the next support at the $1.95 level.

Meanwhile, XRP’s Relative Strength Index (RSI) is at 38, indicating it could face a price decline due to its weak strength. Additionally, the asset’s 200 Exponential Moving Average (EMA) is still below the price, indicating an uptrend.

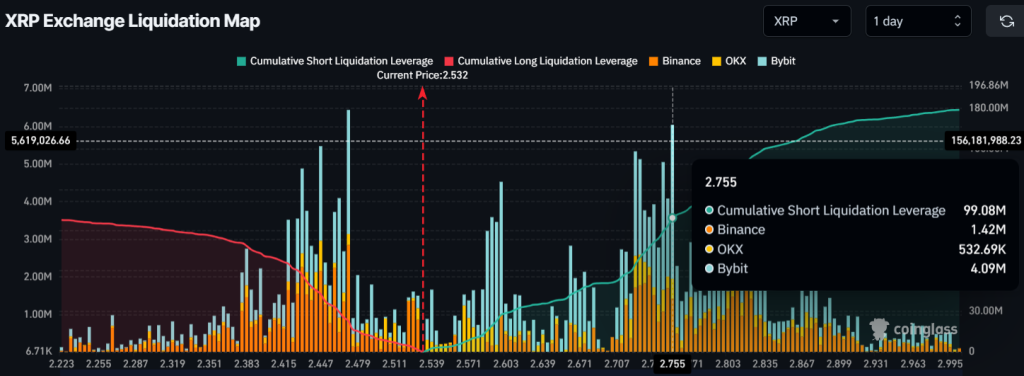

Major Liquidation Areas

With the bearish price momentum, traders holding long positions seem to be liquidating. As of now, the major liquidation areas are near $2.47 on the lower side and $2.75 on the upper side, with traders over-leveraged at these points.

If the current market sentiment remains unchanged and the price falls to the $2.47 level, nearly $22.68 million worth of long positions will be liquidated. Conversely, if the sentiment shifts and the price rises to the $2.75 level, approximately $99 million worth of short positions will be liquidated.

When combining these on-chain metrics with the technical analysis, it appears that bulls are exhausted, and short-sellers are currently dominating the asset, which could lead to further price decline.

Kommentar hinterlassen