Chinese AI startup DeepSeek has sent shockwaves through global financial markets. As the narrative goes mainstream, Bitcoin and crypto markets recorded a bloodbath on Monday, with nearly $1 billion in total liquidations.

Founded less than two years ago, DeepSeek has risen to prominence, positioning itself as a competitor to established AI giants like OpenAI, Meta, and Nvidia.

Crypto Market in Turmoil Amid DeepSeek Hype

The unveiling of DeepSeek has coincided with a sharp sell-off in the crypto market. Bitcoin (BTC) dropped over 5% in a matter of hours, with major altcoins seeing even steeper declines of 8–10%. According to data on Coinglass, in the past 24 hours, 316,282 traders were liquidated, with the total liquidations reaching $861.48 million as of this writing.

Some ascribe the latest market crash to DeepSeek’s growing popularity and its implications for the stock market. Among them was Ash Crypto, an industry veteran who attributed this volatility to broader market reactions stemming from DeepSeek’s ascent.

“This has nothing to do with the crypto market and everything to do with the US stock market,” he explained.

Ash Crypto linked the crypto downturn to a reevaluation of overvalued tech stocks in light of DeepSeek’s competitive edge. Similarly, Ran Neuner, founder of Crypto Banter, issued a stark warning about the potential ripple effects of DeepSeek’s emergence.

He argued that the wealth generated by AI and tech stocks in recent years has been a significant driver of risk-on investment in crypto markets.

“If these stocks take a hit, people will lose fortunes, and this could crash all risk markets as people scramble out of risk,” Neuner said.

The crypto analyst described the situation as a potential “black swan” event. These remarks, among others, highlight how DeepSeek’s rise has unsettled markets.

DeepSeek Emerges as a Disruptive Competitor

With a development cost of under $10 million, DeepSeek has emerged as a disruptive competitor, sparking debate among experts about its long-term implications. Adam Kobeissi, founder of The Kobeissi Letter, highlighted DeepSeek’s unprecedented growth.

Kobeissi contrasted it with OpenAI’s decade-long journey and multibillion-dollar funding, posing a pointed rhetoric on X (formerly Twitter).

“OpenAI was founded 10 years ago, has 4,500 employees, and has raised $6.6 billion in capital. DeepSeek was founded less than 2 years ago, has 200 employees, and was developed for less than $10 million. How are these two companies now competitors?” he wrote.

The disruptive nature of DeepSeek has led Kobeissi to conclude that no company is safe from AI competition. Tommy Shaughnessy of Delphi Ventures echoed this sentiment, emphasizing DeepSeek’s potential to reshape the AI playing field.

He noted that the platform’s open-source nature could catalyze innovation at the application layer, which, in his opinion, could drive a shift away from reliance on costly infrastructure like Nvidia GPUs.

“DeepSeek ensures an open-source future… forcing all AI labs to accelerate innovation,” he said.

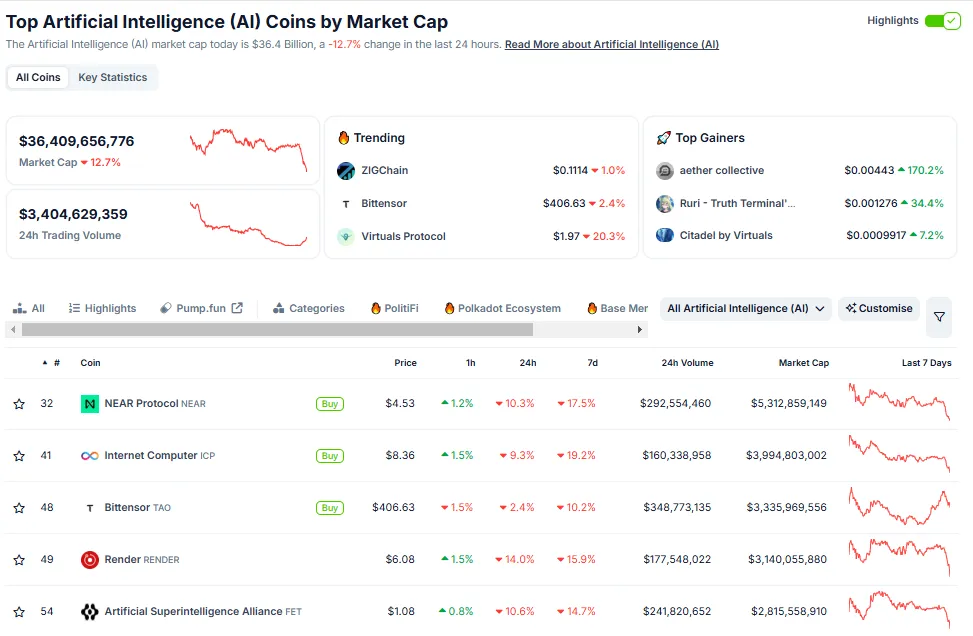

Of note is that the AI crypto segment also suffered in the aftermath of DeepSeek’s rise. Data on CoinGecko shows the market capitalization of AI crypto tokens is down by almost 13% to $36.4 billion.

This slump is likely amid speculation of the implications for GPU demand, which is often a driving fundamental for AI projects. Against this backdrop, Shaughnessy warns that this transformation could destabilize markets, particularly as investors reevaluate the valuations of hardware providers like Nvidia.

Indeed, beyond its low development cost, DeepSeek’s appeal also lies in its efficiency. Unlike traditional AI models, which require significant computational resources, DeepSeek is designed to operate with a fraction of the infrastructure. This raises questions about the long-term viability of high-cost providers like Nvidia and OpenAI.

Kyledoops, a technical analyst at Crypto Banter, tied the market reaction to macroeconomic factors, particularly the Federal Reserve’s upcoming decision on interest rates. He suggested that the Fed’s stance could either exacerbate or alleviate market jitters:

“BTC is plummeting today due to China’s AI DeepSeek triggering market reactions. Could the FOMC meeting become a catalyst for a market move that leaves the bears in disbelief?” Kyledoops wrote.

Despite the immediate market turbulence, some experts see long-term opportunities in the intersection of AI and crypto. Shaughnessy emphasized the potential for intelligent applications and agents to transform industries, driving innovation and value creation at the application layer.

Neuner, while acknowledging the risks, also highlighted the potential for this disruption to force governments to reassess monetary policy.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen