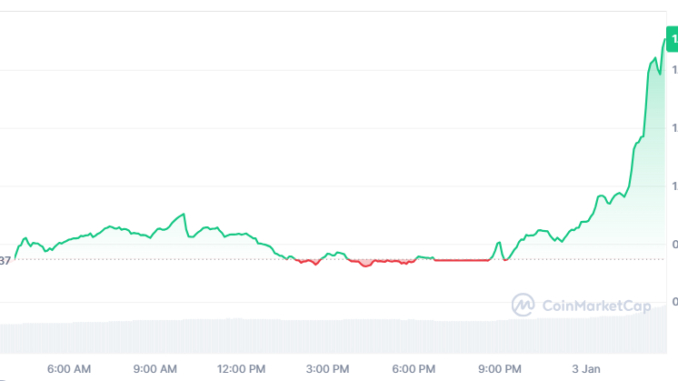

SPX’s price rocketed by 50% during Friday’s intraday trading session. This unexpected price jump triggered a wave of short liquidations, leaving numerous short traders facing substantial losses.

With the SPX token price poised to extend its gains, its short traders may face more liquidations.

SPX Short Traders Record Losses

During Friday’s trading session, SPX value surged by 50%, climbing to a nine-day high of $1.55. This price rally triggered a significant amount of short liquidations in its futures market, totaling $1 million, according to Coinglass data.

Liquidations occur in an asset’s derivatives market when its value moves against a trader’s position. In such cases, the trader’s position is forcefully closed due to insufficient funds to maintain it.

Short liquidations happen when traders with short positions are forced to buy back an asset at a higher price to cover their losses as its value increases. This takes place when the asset’s price surpasses a critical level, forcing traders who were betting on a decline to exit the market.

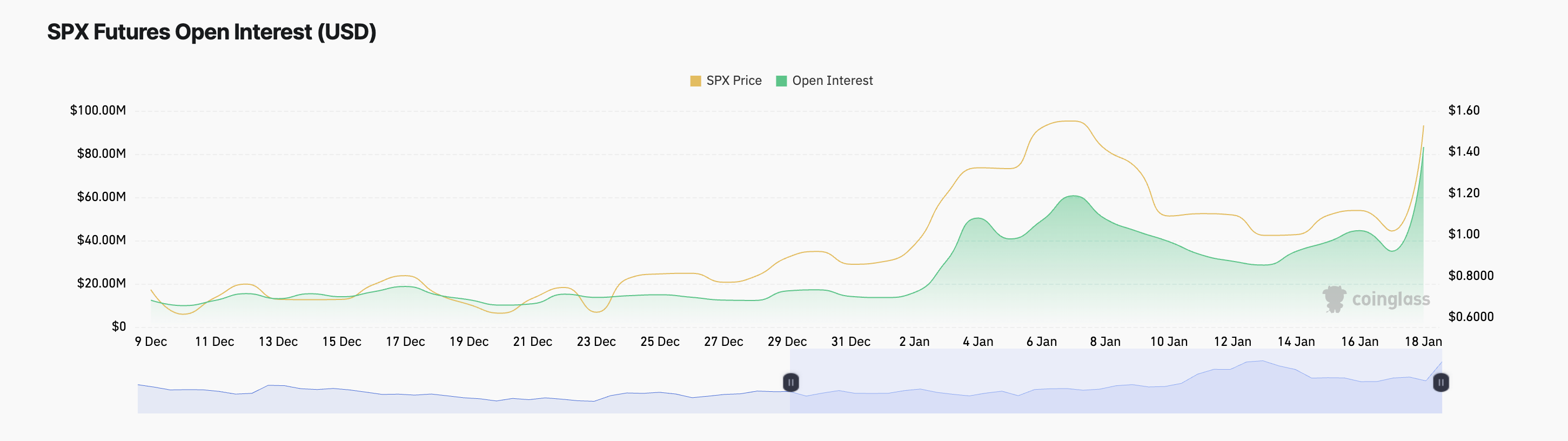

Notably, this might not be the end of losses for SPX’s traders as trading activity continues to climb. This is evidenced by the token’s open interest, which has increased by 137% in the past 24 hours. This has happened amid the 32% surge in the token’s value during the same period.

Open interest tracks the total number of outstanding derivative contracts that have not been settled, such as futures or options. When it spikes during a price rally like this, it signals increased market participation and confidence in the upward price movement.

Therefore, if the SPX price uptrend persists, its short traders will suffer more losses.

SPX Price Prediction: Token Eyes All-Time High

SPX’s 50% surge has prompted a shift in the position of its Super Trend indicator. It is now a green line offering dynamic support below the token’s price on the daily chart.

This indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the current market trend: green for an uptrend and red for a downtrend.

When an asset’s price trades above the Super Trend indicator, it is in a bullish trend. This signals that buying pressure outweighs selling activity among market participants.

If this continues, SPX’s price will rally to revisit its all-time high at $1.65. However, if selloffs commence, the SPX token price will lose its recent gains and could drop to $1.23.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen