VIRTUAL price has surged over 18% in the last 24 hours, reclaiming its $2 billion market cap as AI coins recover from the recent correction. Despite this rally, technical indicators like the ADX and BBTrend highlight ongoing challenges, with momentum still weak and selling pressure yet to dissipate fully.

Key levels, including the $2.81 support and $3.27 resistance, will determine whether VIRTUAL can sustain its upward momentum or face renewed bearish pressure.

VIRTUAL Downtrend Has Lost Its Steam

VIRTUAL ADX has dropped to 16.3 from 26.8 in the last two days, indicating a significant weakening in trend strength. An ADX below 20 generally signifies a lack of a strong trend, suggesting consolidation or market indecision.

This decline in ADX reflects that the ongoing attempt to transition from a downtrend to an uptrend lacks sufficient momentum to establish a clear directional move.

The ADX, or Average Directional Index, measures the strength of a trend without indicating its direction. Values below 20 signal a weak trend and above 25 reflect a stronger, more defined trend. VIRTUAL current ADX at 16.3 suggests that while it is trying to shift into an uptrend, the trend is not yet solidified.

For a clear confirmation of an uptrend, the ADX would need to rise above 25, accompanied by sustained buying pressure to build stronger momentum, as the hype around crypto AI agents recovers its momentum.

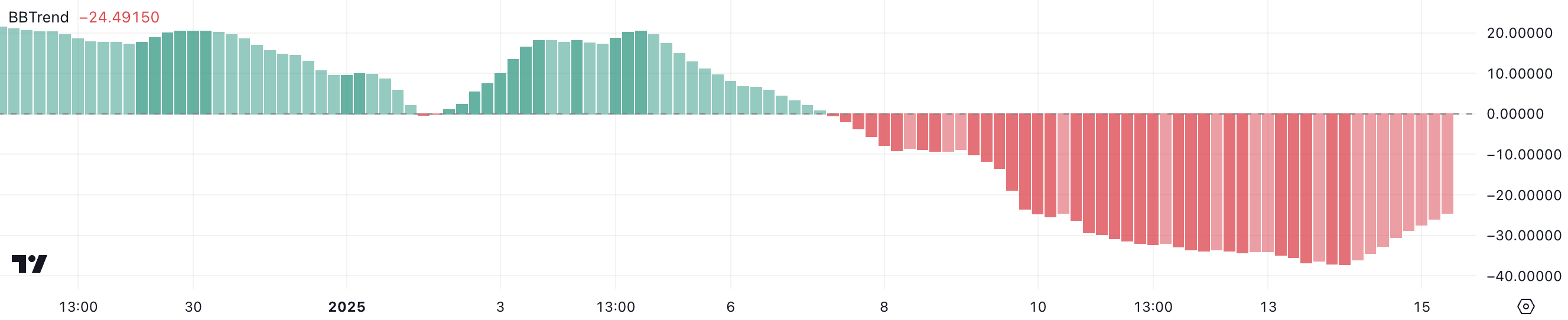

VIRTUAL BBTrend Stays Negative Since January 7

VIRTUAL’s BBTrend has been negative since January 7, recently peaking at -37.2 yesterday before recovering to -24.4. Although still in negative territory, the improvement suggests that bearish momentum is easing.

This shift indicates a potential stabilization in VIRTUAL price, though the negative BBTrend highlights that selling pressure still outweighs buying activity.

The BBTrend, or Bollinger Band Trend, measures price deviations relative to Bollinger Bands to assess trend strength and direction. Negative values indicate bearish conditions, while positive values signal bullish trends. With VIRTUAL BBTrend at -24.4, the current reading reflects ongoing bearish sentiment but hints at a possible transition toward neutrality.

If the BBTrend continues to recover, it could signal a weakening downtrend and pave the way for potential price stabilization or reversal.

VIRTUAL Price Prediction: Potential 26% Upside

VIRTUAL price has a critical support at $2.81, which, if breached, could result in a further decline to $2.23. While VIRTUAL EMA lines still display a bearish setup, with short-term lines below long-term ones, the upward movement of the short-term lines suggests a potential shift.

If these lines cross to form a golden cross, it could signal a bullish reversal, making VIRTUAL one of the biggest artificial intelligence coins in the market. In such a scenario, VIRTUAL could test the resistance at $3.27 and, if broken, aim for $3.73, offering a potential 26% upside.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen