Key Takeaways

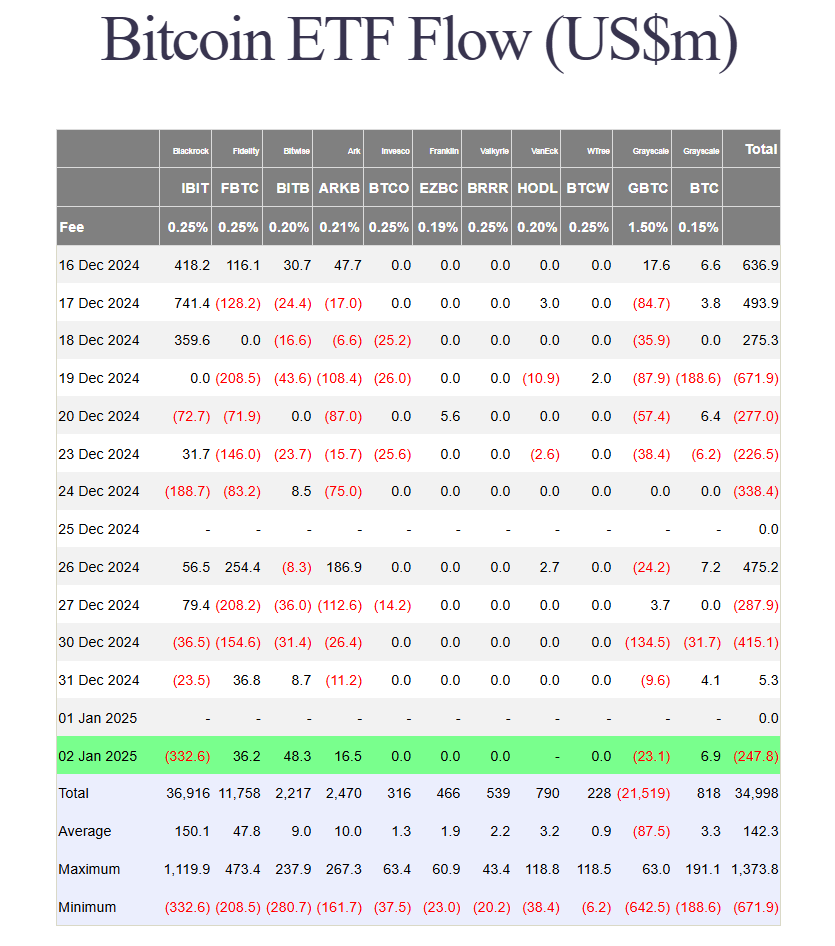

- BlackRock’s IBIT experienced a record single-day outflow of $332 million on January 1.

- US spot Bitcoin ETFs collectively faced outflows of $650 million for the week.

Share this article

BlackRock’s iShares Bitcoin Trust (IBIT) recorded its largest single-day outflow of over $332 million on January 1, surpassing its previous record of $188 million set on December 24, according to updated data from Farside Investors.

The massive IBIT withdrawals pushed US spot Bitcoin ETF’s overall flows into red territory on Thursday, even as most rival ETFs posted gains. The Grayscale Bitcoin Trust (GBTC) also saw losses of nearly $7 million.

Bitwise Bitcoin ETF (BITB) led daily inflows with $48 million, followed by Fidelity Wise Origin Bitcoin Fund (FBTC), ARK 21Shares Bitcoin (ARKB), and Grayscale Bitcoin Mini Trust (BTC). These funds collectively took in approximately $108 million on Thursday.

Excluding Valkyrie’s Bitcoin ETF, the 10 US-based spot Bitcoin ETFs recorded combined outflows of $248 million. The week’s total net outflows have surpassed $650 million.

IBIT’s total net outflows have reached $392 million since December 3, marking three consecutive trading days of losses. Despite the recent outflows, the fund remains the dominant Bitcoin ETF, holding nearly 552,000 BTC valued at over $51 billion as of January 2.

Launched in early 2024, IBIT outperformed the vast majority of ETFs throughout the year. The fund ranked third on Bloomberg ETF analyst Eric Balchunas’ 2024 leaderboard with approximately $37 billion in year-to-date flows, trailing only the established index giants VOO and IVV.

Here’s final 2024 Top 20 ETF Leaderboard: $VOO ended w/ $116b which is $65b beyond old record (absurd). $IVV closed strong w $89b (bc used more than $SPY for TLH?). $IBIT took 3rd spot w $37b (still <1yr old!). Total flows at $1.14T, which broke old record by 25%, or $225b..🔥🔥 pic.twitter.com/RRCbHEAN9Q

— Eric Balchunas (@EricBalchunas) January 2, 2025

Share this article

Kommentar hinterlassen