Several events are in the pipeline for the crypto industry this week, like Frax Finance revamping its FRAX stablecoin into a new BUIDL-backed asset, Sui unlocking 64 million governance tokens, and six Israeli investment firms launching Bitcoin mutual funds.

Web3 SDK platform Empyreal will also launch a no-code AI Agent Launchpad. Furthermore, Pendle will perform an airdrop, Movement’s Mainnet Launch is scheduled, and GammaSwap’s yield tokens are having an audit. Overall, it’s a jam-packed week for the crypto community to kickstart 2025.

Frax Votes for BUIDL-Backed Stablecoin

Frax Finance is voting to use BlackRock’s tokenized fund BUIDL as the backing asset for its refreshed frxUSD stablecoin, which will end tomorrow.

The DeFi “Central Bank of Crypto” has been launching stablecoin solutions for years, and now it’s planning to convert its existing FRAX stablecoin into frxUSD. At the time of writing, the voters unanimously favor adopting the proposal.

“Securitize has submitted a proposal to integrate BlackRock’s BUIDL token as a reserve backing for Frax’s soon-to-be-relaunched frxUSD stablecoin. By bridging institutional-grade assets with decentralized finance, we’re driving the next wave of innovation in stablecoins,” Securitize claimed via social media.

In October, BlackRock publicly claimed that it wants exchanges to use its BUIDL token as collateral for derivative assets. Although Frax Finance’s new product is not one of these, it’s not the only BUIDL-backed stablecoin to launch recently. Earlier this month, Ethena Labs used BUIDL to back its new USDtb asset.

BlackRock has directed BUIDL to make several major expansions in the crypto space recently. Frax’s vote will close in one day, and the community has no substantial opposition to the proposal. It’s extremely likely that this plan will go through.

Sui to Unlock 64 Million Tokens

The popular layer-1 blockchain Sui network is preparing for a major token unlock this week. On January 1, the protocol will unlock 64 million SUI tokens, next to a current circulating supply of 2.92 billion. Even after this major release, the vast majority of tokens will remain out of circulation.

SUI is a governance token, and the primary beneficiaries of this unlock will be early investors and contributors. Specifically, unlocked tokens will go to Series A and B participants, the community reserve, and the Mysten Labs treasury.

Bitcoin ETFs Elusive for Israel, Mutual Funds Launch

Six Israeli investment firms are preparing to launch Bitcoin-based mutual funds this week. Bitcoin mutual funds were the hottest several years ago when the ETFs didn’t have regulatory approval.

In 2024, however, new crypto mutual funds are mostly for assets that don’t have a viable ETF. Although Israeli businesses are fighting for them, there’s been little success.

“The investment houses have been pleading for more than a year for ETFs to be approved, and started sending prospectuses for bitcoin funds in the middle of the year. The regulator marches to its own tune. It has to check the details,” an anonymous investment house executive told local media.

In other words, these plans may come too late to make a substantial impact, considering that Bitcoin could be on the verge of a bear market.

Additionally, regardless of Bitcoin’s performance, local investment factors have an outsized influence on these products. For example, Hong Kong’s Bitcoin ETFs were hotly anticipated, yet their actual release was very disappointing.

Overall, the timing of this launch is questionable as BTC mutual funds are out of the limelight, thanks to the ETF craze. Since Israel’s latest war began in 2023, foreign investment has cratered, with capital flight surging 63% by October 2024.

The nation’s domestic tech sector also suffers from decreased funding. With these unfavorable factors in play, BTC mutual funds may flop, too.

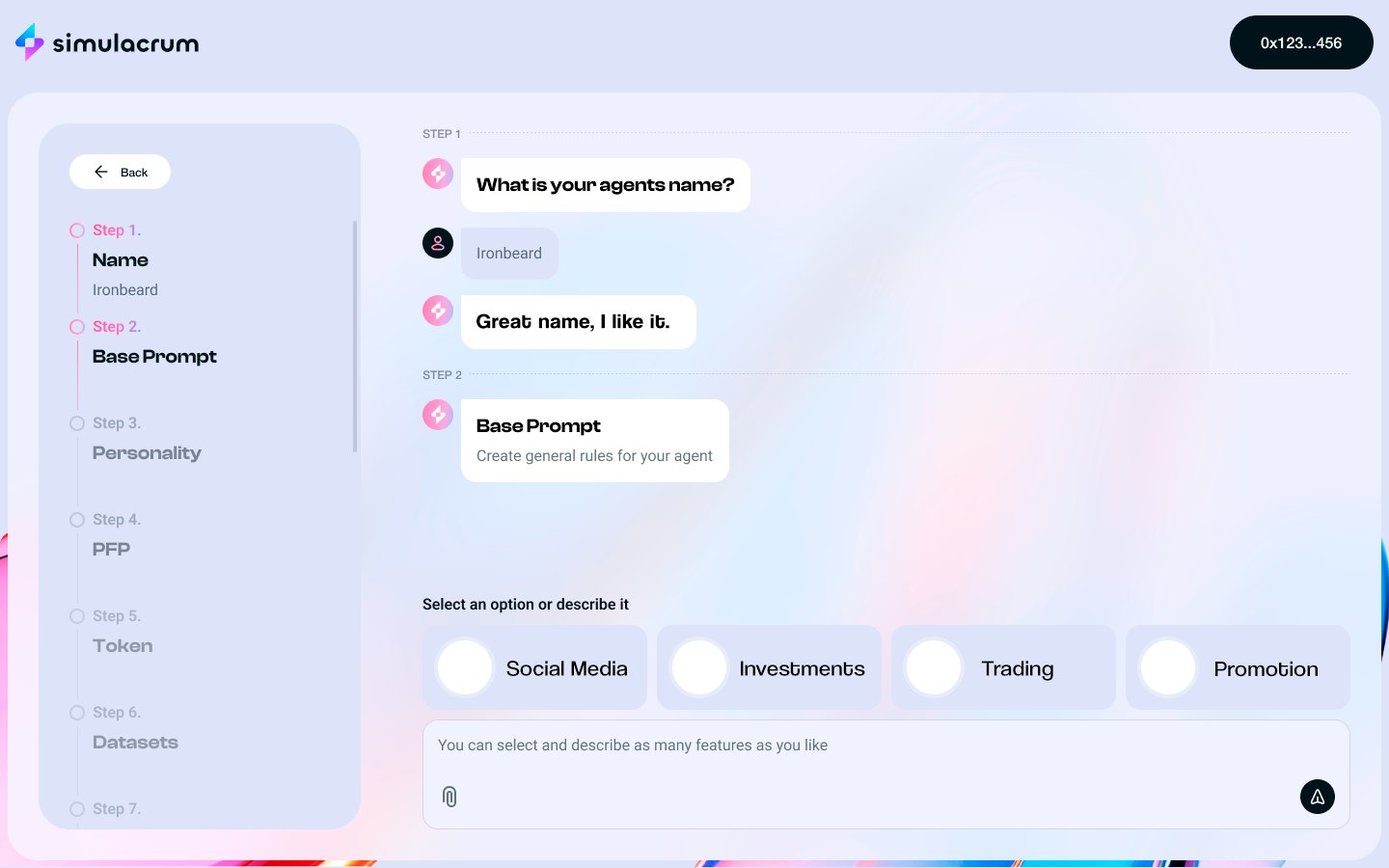

Empyreal To Power No-Code AI Agent Launchpad

Empyreal, a web3 infrastructure company, is set to deploy a launchpad for no-code AI agents. Simulacrum AI is conducting the main operation, while Empyreal’s underlying technology will power the main functions.

Through this no-code platform, users will be able to customize these AI agents in a few ways, including their interactions with users and custom datasets. These agents will also be able to launch tokens and manage their treasuries. The first live test will be conducted through Simulacrum, an AI protocol.

Pendle Airdrop, Movement Mainnet, GammaSwap Audit

On December 31, Pendle will take a snapshot of users who have staked the firm’s vePENDLE asset, and these users will receive a new airdrop of more tokens. Pendle’s token value has suffered despite the crypto bull market, as one of its biggest advocates, Arthur Hayes, dumped huge amounts of it.

Movement is preparing for a Mainnet launch in January after a successful beta deployment earlier this month. The platform’s MOVE token jumped in the crypto market after this launch, and developers are expecting further success for the first Move-based Ethereum L2.

GammaSwap, an on-chain perpetual options protocol, has an audit scheduled for today. This audit concerns GammaSwap’s Yield Tokens, which can enable users to earn 60-80% APY for Ethereum.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen