Bitcoin struggles to recover from the big drop. It fell down to $92,000 as we predicted in our analysis yesterday. Though BTC has moved up by 5%, it still lies in a danger zone. Let’s analyse market metrics to understand what is happening and what to expect.

The Bitcoin Chart

Bitcoin is currently trading at $97,536 and is trying to move ahead. The presence of Moving Average 200 is active as the active resistance here. The RSI has also risen and has moved out of the oversold zone, however the danger of pullback remains. If the market does not get enough buying volume, the MA 200 can push the price back down. Earlier, it received support around $92k due to the presence of MA 50 on the daily chart, however that might not be enough this time. The Greed and Fear index is at 73, however the real market sentiment is still bearish.

The MACD histogram shows reduction in selling pressure, however the average direction index has fallen to 33.62 which is not a good sign for Bitcoin. We can also see the moving average 20 has fallen below MA 50 and 100 which sends a negative impression to the market. If the price keeps on consolidating in this area or it moves a little down the smallest MA will go below the highest and it will trigger a panic in the market. This could send the price down to $90k or even bad.

The Liquidation Data

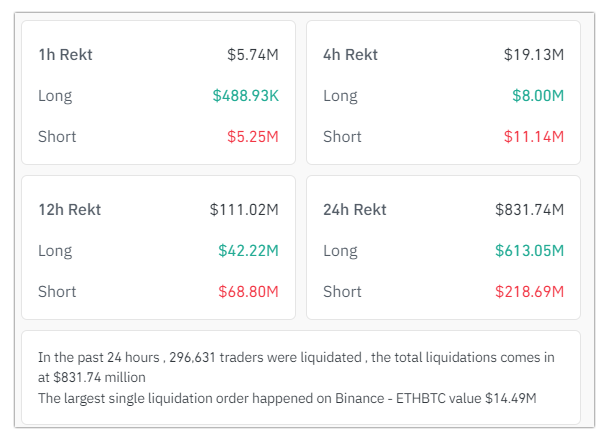

According to Coinglass’s crypto liquidation data, in the past 24 hours, 296,631 traders got liquidated. This caused a total of $831.74 million to wash out of the market. Yesterday this amount went over $1 billion. The last 4 days have been very bad for the long traders as the market kept on going down.

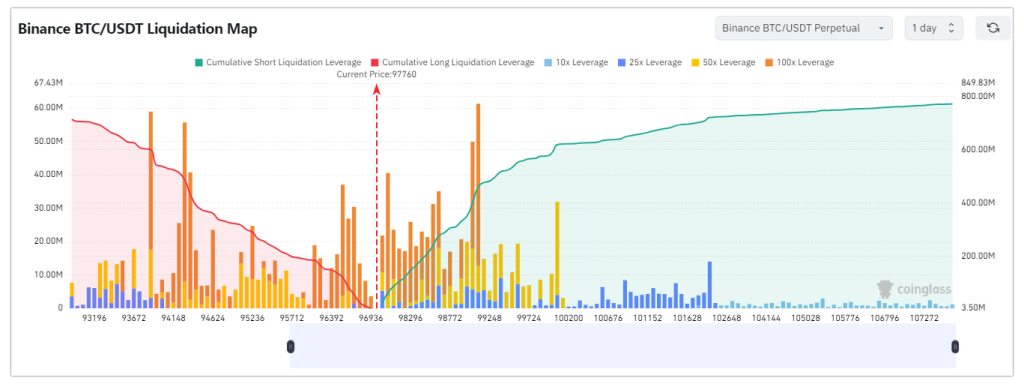

The liquidation map shows that there are still traders who have opened long trades for Bitcoin with high leverages upto 100x. Taking some decisions in time of a bearish momentum shows there are still people out there who do not understand the gravity of the situation. The map also shows the short trades with high leverages. During such periods, the market has a tendency to suddenly move in the opposite direction to liquidate traders with bad risk management.

What to Expect

The very first thing we should be seeing now is Bitcoin price coming above the moving average 200. That will decrease the negative sentiment from the market and encourage more investors to jump in. However, for this to happen the market needs some buying volume. The market could make a sudden spike, just to liquidate the careless short traders, and this will give support to the market. Yes, not everything can be good for everybody, but let’s see the big picture here. If Bitcoin stays in this dangerous zone, it might fall down to $90k, triggering a panic sell resulting in altcoins rolling down as well.

What do you think will happen? The market will rise or will it go down further?

Kommentar hinterlassen