Key Takeaways

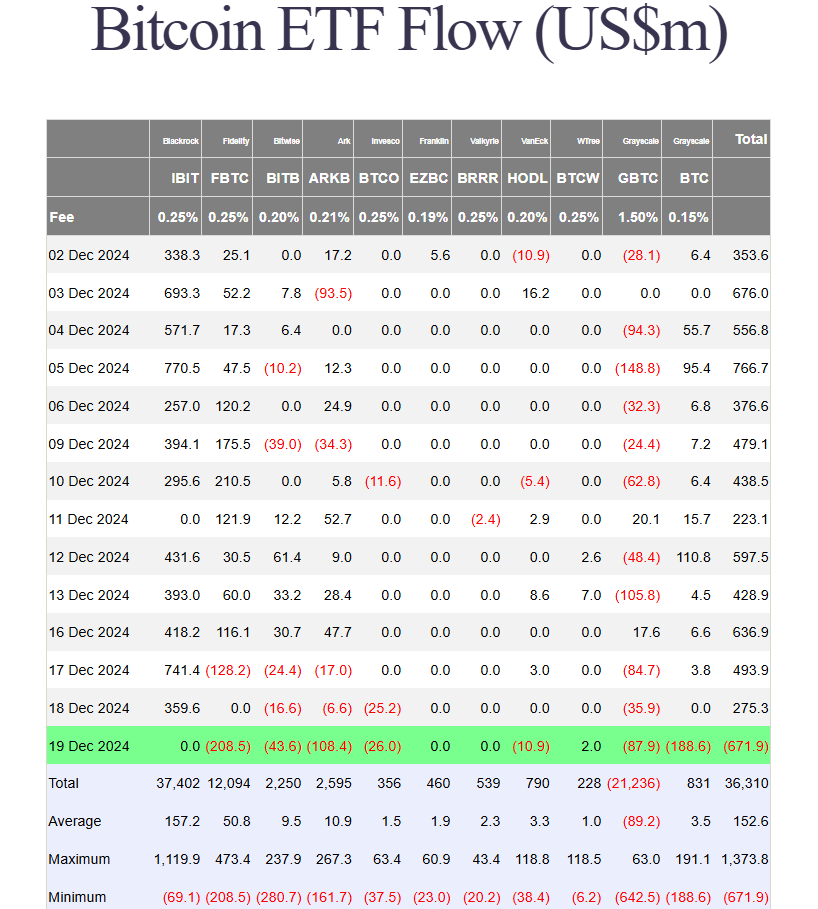

- US Bitcoin ETFs experienced historic outflows with investors withdrawing $672 million in a day.

- Fidelity’s Bitcoin Fund led the outflows, followed by Grayscale and ARK Invest ETFs.

Share this article

US spot Bitcoin ETFs experienced their largest single-day outflows on record, with investors withdrawing approximately $672 million on Thursday amid a broad crypto market decline post-Fed policy meeting, Farside Investors data shows.

The massive withdrawal marked the end of a two-week positive streak for the 11 funds that directly hold Bitcoin. The previous outflow record was set on May 1, when the funds saw nearly $564 million in withdrawals after Bitcoin dropped 10% to $60,000 over a week.

Fidelity’s Bitcoin Fund (FBTC) led the exodus with $208.5 million in outflows, while Grayscale’s Bitcoin Mini Trust (BTC) recorded its lowest point since launch with over $188 million in net outflows.

ARK Invest’s Bitcoin ETF (ARKB) and Grayscale’s Bitcoin Trust (GBTC) also saw huge withdrawals, with ARKB losing $108 million and GBTC shedding nearly $88 million.

Three competing ETFs managed by Bitwise, Invesco, and Valkyrie collectively lost $80 million.

BlackRock’s iShares Bitcoin Trust (IBIT), which has accumulated $1.9 billion in net inflows so far this week and was a major contributor to the group’s recent strong performance, recorded zero flows for the day.

WisdomTree’s Bitcoin Fund (BTCW) was the sole gainer, attracting $2 million in new investments.

Bitcoin’s price fell below $96,000 during the market downturn and currently trades at around $97,000, down 4% over 24 hours, according to CoinGecko data. The steep decline across all assets triggered $1 billion in leveraged liquidations on Thursday, Crypto Briefing reported.

The market turbulence followed the Fed’s hawkish messaging after its rate cut decision. The Fed implemented a 25-basis-point rate reduction on Wednesday but indicated fewer cuts in 2025.

Although price volatility persists, the Crypto Fear and Greed Index still indicates greed sentiment at 74, down only one point from yesterday.

Share this article

Kommentar hinterlassen