Nearly $1.25 billion has been liquidated from the crypto market over the past 24 hours, as the market’s nearly down 10%.

Bitcoin dipped below $96,000, with meme coins seeing the highest loss on Thursday.

Inflation Forecast Triggers Massive Corrections in the Crypto Market

According to Coinglass data, Bitcoin saw over $45 million in liquidation today, while Ethereum saw nearly $30 million. This major correction occurred after the Federal Reserve cut interest rates by 25 basis points on Wednesday.

Usually, an interest rate cut is bullish for crypto, as lower rates signal a softer monetary policy. However, what impacted the market was the Fed’s 2025 projections. Jerome Powell said that the Federal Reserve is predicting higher inflation and only two interest rate cuts next year.

While this level of liquidation is significant, the impact on the stock market is more severe. Nearly $1.5 trillion was wiped out from the US market. These heavy liquidations are driving concerns for a potential bearish cycle.

“Hey guys, now that the bull market’s officially over I just wanted to extend a wholehearted thank you to everyone. I’ll be deleting all crypto related socials and logging off,” one influencer posted on X (formerly Twitter)

However, the prevailing perspective of most analysts seems to indicate that today’s liquidation is just a short-term flushout.

“Bitcoin Market Sentiment. It’s the same story every time, and it never changes. Markets aren’t designed for the majority to win. Corrections are a natural part of bull markets,” wrote popular analyst ‘Titan of Crypto’.

Other analysts, like Philakone, emphasized that these liquidations generally happen at the end of a bullish year when the market enters a cool-off period. He also predicted that the bullish sentiment would return after December 17 and sustain until the first week of January.

Meanwhile, some analysts are forecasting an altcoin season. Increasing liquidation for Bitcoin will impact its dominance in the coming months and create more scope for major altcoins like Ethereum and Solana.

“If you think the altcoin season is over, you need to know this: The total altcoin market cap (excluding BTC & ETH) is sitting at around $1.05 trillion. It’s tapping at the previous altcoin market cap high from November 2021. The last time something similar happened was in Feb 2021, when this altcoin market cap tested the previous high from Jan 2018,” wrote Lark Davis.

While the Fed’s forecast had a notable impact on the market today, it’s important to understand that Bitcoin is still up by nearly 130% this year. Most importantly, several developments in the crypto industry outweigh these macroeconomic factors.

Michael Saylor’s MicroStrategy, which owns nearly 2% of Bitcoin’s supply, has made consecutive purchases since November. The firm even bought $3 billion worth of BTC in December, while assets hovered above $100,000.

Also, other public companies like MARA and Riot Plaforms have pursued similar Bitcoin acquisition strategies this month. There are also potential regulatory shifts to look forward. Global lawmakers across different countries are advocating for a Bitcoin reserve.

So, while the macroeconomic factors have raised momentary bearish signals, the long-term outlook for 2025 still remains bullish.

Shrinking Supply Signal Potential Bitcoin Supply Shock

Another reason why we think Bitcoin will continue to remain bullish is its supply and demand ratio.

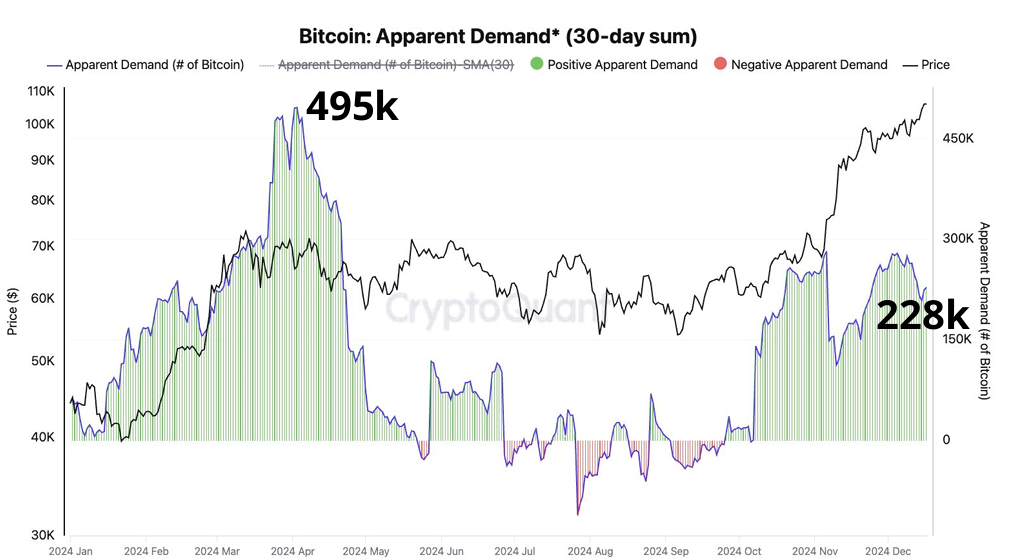

According to data from CryptoQuant, the Bitcoin market is showing signs of a potential supply shock as rising demand meets a shrinking supply of BTC available for sale. Bitcoin demand is rising, with accumulator addresses adding 495,000 Bitcoin monthly.

Meanwhile, the stablecoin market cap hit $200 billion, signaling fresh liquidity. Optimism around pro-crypto policies and potential US initiatives further fuels demand.

On the other hand, sell-side liquidity has dropped to 3.397 million Bitcoin, the lowest since 2020, including exchanges, miners, and OTC desks. The inventory ratio, which measures how long current supply can meet demand, has plummeted to 6.6 months from 41 months in October, highlighting the tightening market conditions.

So, this supply shock, along with the macroeconomic factors, could be the key catalyst behind today’s liquidations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen