Hedera (HBAR) open interest has hit a new all-time high following its 600% price increase in the last 30 days. This rise signifies the highest trader interaction with the token since its inception.

Looking ahead, several key indicators suggest HBAR’s price rally and bullish momentum may persist. Based on this on-chain analysis, here is what could be next for the cryptocurrency.

Hedera Has Traders’ Attention on Lock

Some days back, BeInCrypto reported how HBAR’s open interest surged to $220 million. But as of this writing, the same indicator, according to Glassnode, has risen to $417.98 million. OI, as it is fondly called, represents the total number of open positions in a contract, with each position having an equal buyer and seller.

An increase in OI suggests that traders are actively increasing their market positions, with buyers becoming more aggressive than sellers, driving the overall net positioning higher. Conversely, when OI decreases, it indicates that market participants are reducing their positions, signaling less market activity.

Furthermore, the rising price paired with increasing OI may seem to suggest more longs (buyers) than shorts (sellers). The true takeaway is that participants are either ramping up or unwinding their positions, with a growing OI typically indicating a stronger trend.

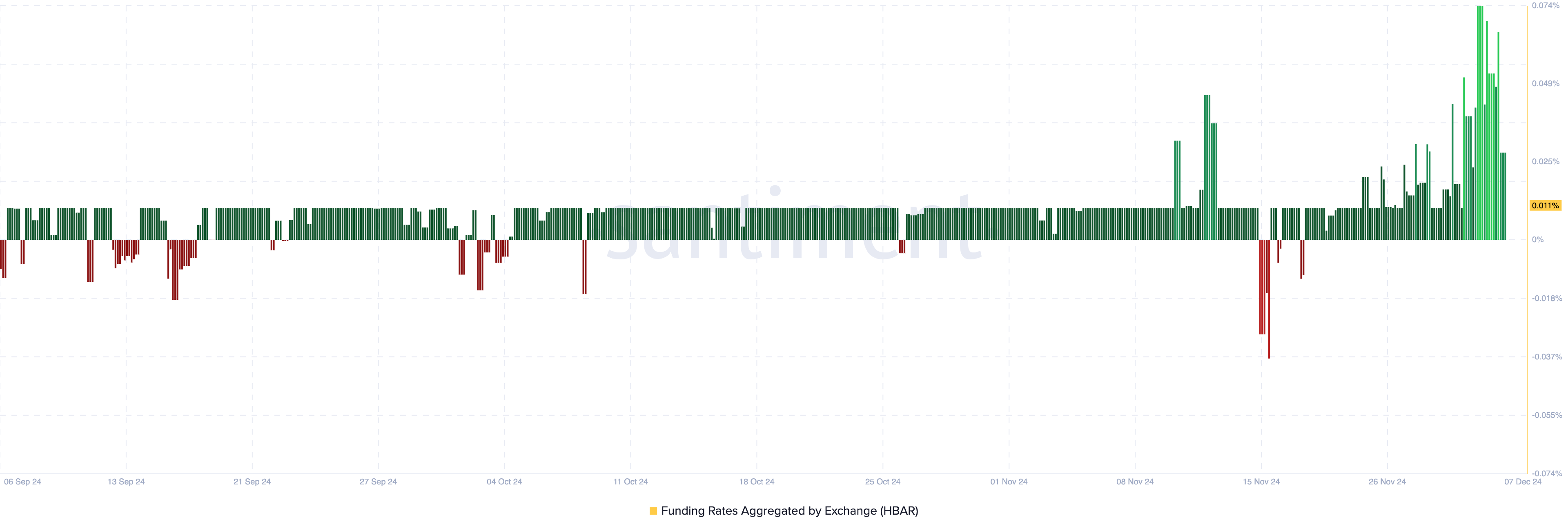

Therefore, the increase in the altcoin’s OI with the recent rally suggests that HBAR’s price might soon trade higher. Meanwhile, the token’s funding rate has also remained in the positive region.

A positive funding rate indicates that the contract price is trading at a premium to the index price, with long positions paying funding to short positions. Conversely, when the funding rate is negative, the perpetual contract price trades at a discount to the index price, meaning short positions pay funding to long positions.

Considering the current position, longs are paying a funding fee to shorts, suggesting that traders are betting on a further price increase.

HBAR Price Prediction: Rally to Accelerate

On the 4-hour chart, HBAR’s price has broken out of a descending triangle that formed between December 3 and 6. A descending triangle is a pattern that typically signifies a potential downtrend.

It forms with a descending upper trendline, indicating lower highs, and a flat horizontal trendline at a lower level, acting as support. As the price approaches the apex of the triangle, a breakdown below the support level often suggests a continuation of the downtrend.

However, HBAR did not break below the support level. Instead, it surged above the lowest level of the falling channel. With this trend, the token’s value will likely rise to $0.42 in the short term.

In the long term, HBAR’s price could be higher. However, retracement below the support line at $0.28 could send the cryptocurrency further down. If that happens and HBAR Open Interest drops, the price could decline to $0.22.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen