Although Render’s (RNDR) price is not observing explicit bullishness on the charts, it is seeing a lot of hype from investors.

This could result in the cryptocurrency noting new highs for 2024, setting it up for further rise.

Render Investors Take the Bullish Route

Render price trading under $11 failed to breach the resistance marked at $11.24, resulting in some pullback in price. But this did not seem to discourage RNDR holders who have been actively bullish towards the altcoin.

According to the supply on exchanges, about 2 million RNDR worth over $21.8 million have moved out of the exchanges. Investors purchased this supply in the last four days, even though RNDR was painting red on the charts.

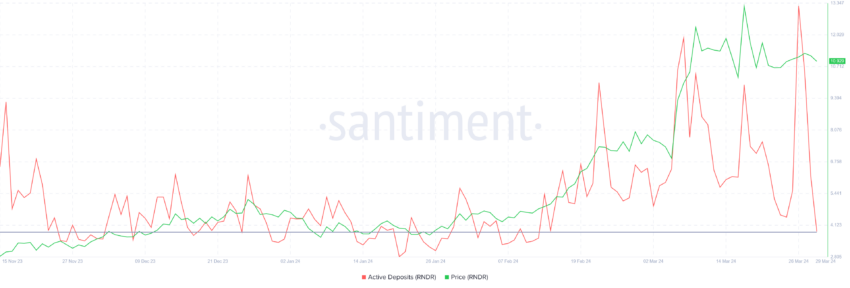

But it’s not just accumulation that is a positive development; the conviction among investors is rising, too. This is evinced by the plunge in active deposits, which highlights the intention of selling among RNDR holders.

At the time of writing, the active deposits are at a two-month low, which shows that the potential of selling has gone down. This would support an increase in price.

Read More: 10 of the Most Common Web3 Interview Questions and Answers

RNDR Price Prediction: New Highs Await?

Render price hit a high of $13 earlier this month, nearly touching $14 during the intra-day high, marking the year-to-date high. If the investor’s bullishness persists, RNDR might have another shot at forming new 2024 highs.

In order to make this happen, Render price would need to flip the resistance of $11.24 and $12.58 into support. This would enable a further rise in price.

Read More: Top 9 Web3 Projects That Are Revolutionizing the Industry

However, if RNDR fails to breach the resistance levels again, it might lose the bullish momentum and witness a decline that could pull it down to $10.2. Losing this level would cause a major correction in price, potentially sending it to $8 and resulting in the invalidation of the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kommentar hinterlassen